IL Exclusive Report: 5 Significant Service Trends

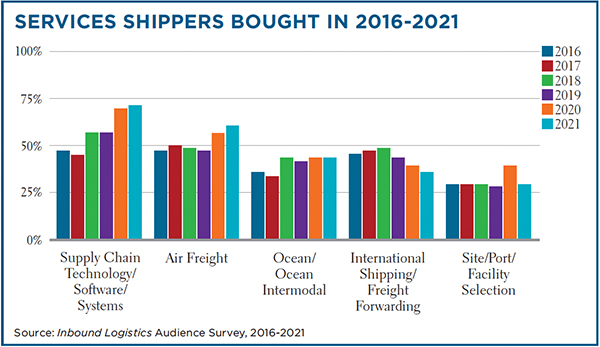

Which services are shippers buying, and what does that say about the current supply chain landscape? Take a look at five significant trends based on data from shippers responding to Inbound Logistics’ audience survey from July 2016 to July 2021:

1. Drop in site selection: The number of respondents making site, port, and facility selection investments dropped from a five-year high of 38% in 2020 back down to 30% in 2021, indicating port congestion may be steering shippers away. Because it is more difficult to get product, many are choosing whichever port is experiencing the least delays at any given time.

2. Bump in air freight: Air freight investments increased from 48% of respondents in 2019 to 56% in 2021. Because ocean shipping is currently experiencing delays and cost increases, more shippers are considering charter options and different modes. For some, shifting to air freight may be worth it, even if it’s more expensive.

3. International shipping fluctuations: International shipping and freight forwarding investments went from jumping 3% between 2016 and 2018 to dropping by 9% in 2020 and another 5% in 2021. This shows that capacity is not keeping up with demand, as well as a possible mode shift due to capacity constraints.

4. No stopping technology: From 2016 to 2020, respondents increased supply chain technology investments by 24%. Another big jump occurred from 2019 to 2020 at 16%. Investments keep growing, reaching 73% in 2021.

5. Ceilings for some modes: Certain modes have a clear capacity ceiling while others do not, even when interest spikes. For example, the highs for ocean/ocean intermodal, which occurred in 2018, 2020, and 2021, never exceeded 44%. Supply chain technology, however, keeps ballooning.