COVID-19’s Impact on North American Manufacturers

Manufacturer interest in reshoring, hiring, and apprenticeships is increasing during the pandemic, finds Thomas’ latest COVID-19 Manufacturing Survey.

Thomas’ May/June 2020 COVID-19 Manufacturing Survey (with 746 qualified manufacturing respondents) reveals the following key trends:

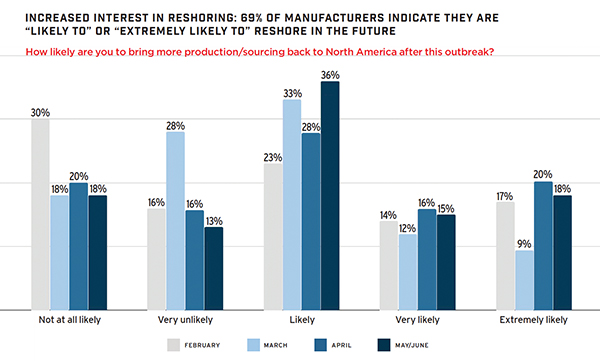

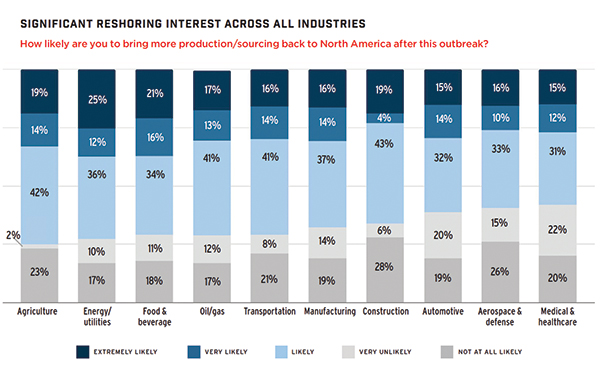

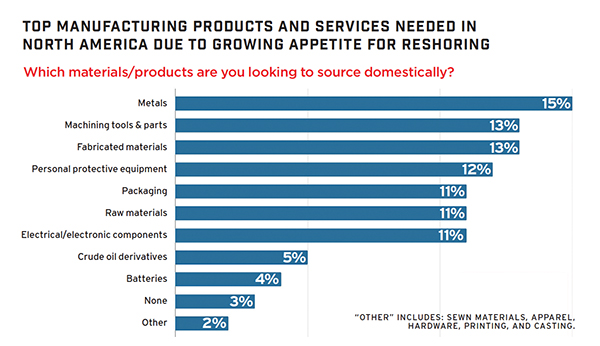

1. Stronger reshoring interest.

Two in three manufacturers (69%) indicate they are “likely to” or “extremely likely to” reshore (up from 54% in February 2020), with agricultural, energy/utilities, and food & beverage leading in interest.

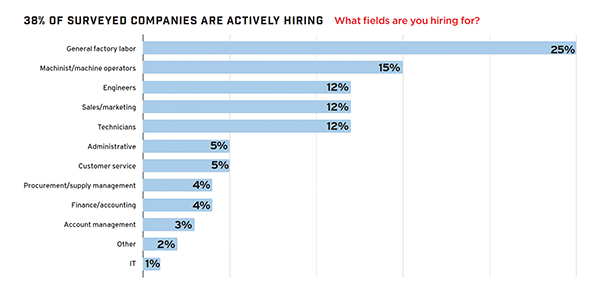

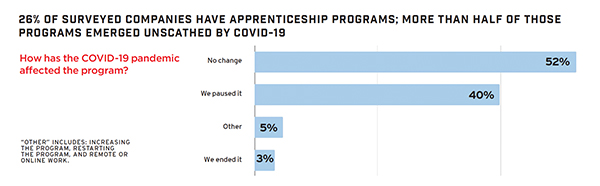

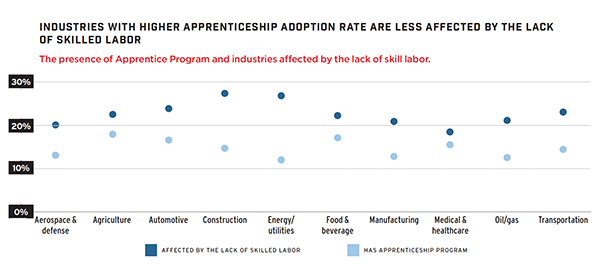

2. The need for skilled labor and apprenticeships.

One in three (38%) companies surveyed are actively hiring. Industries engaged in apprenticeship programs were less impacted by the lack of skilled labor.

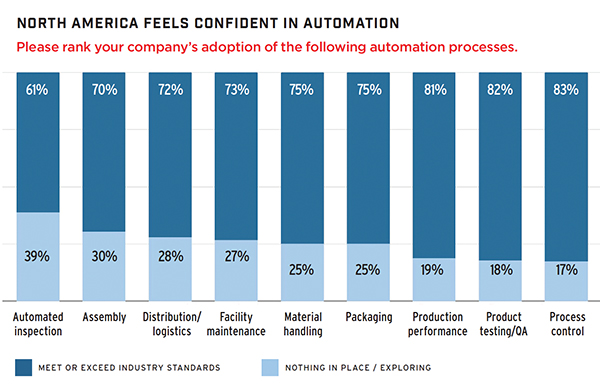

3. North America is confident in automation.

More than half of respondents feel that they meet or exceed industry standards on automation processes.

4. Digital marketing transformation is no longer optional.

Marketing avenues identified as “extremely important” to attract new customers: website (84%), email (73%), and a surge of virtual events, such as webinars (from 15% to 32% post-COVID-19).

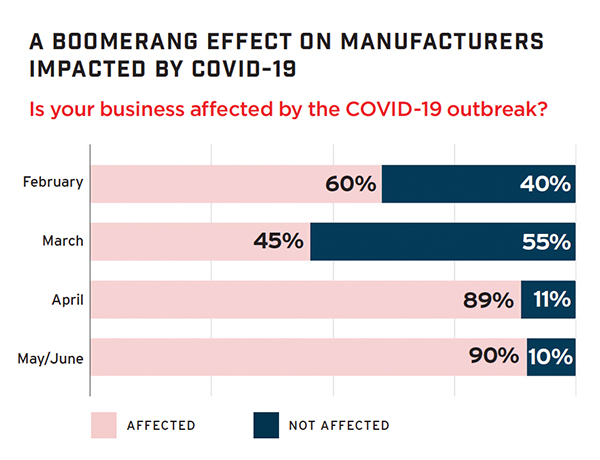

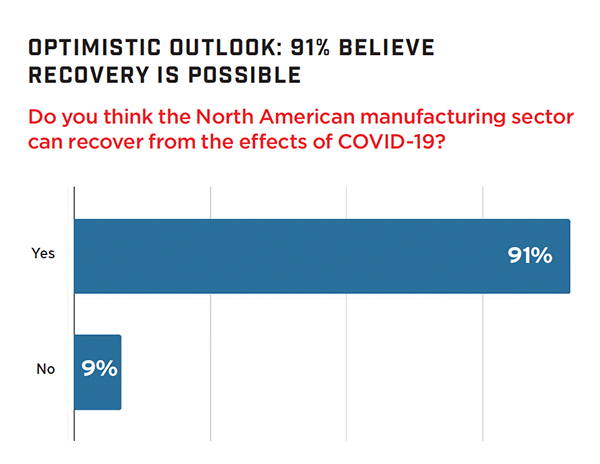

5. Companies remain optimistic about the future.

Although COVID-19 impacts are undeniable (90%), 91% of respondents believe that North American manufacturing can recover from the pandemic.

Reshoring Trends and Insights

*Survey participants are able to choose more than one answer; therefore, total percentages may exceed 100%. Percentage = count of responses/total respondents.

MANUFACTURING STEPS UP IN TIME OF CRISIS

“I think this pandemic has caused a refocus of where we get raw materials, products, and services. In a twinkling of an eye we can lose our connection with companies abroad. Doing more business domestically will force our nation to revisit labor rates which was a big driver at companies looking abroad.”

“The increased communication between industry peers and across industries has been encouraging, [and has] inspired learning and support.”

“We not only source our materials from the U.S., we source most of them locally in Michigan, which makes it a little easy to navigate supply chain issues… We also hire almost exclusively from competitive high school robotics teams.”

“I was so impressed by manufacturers who made adaptations to their lines and went from making cars to making ventilators or from making craft beer to making hand sanitizer or from making designer clothes to making face masks.”

MANUFACTURERS’ OUTLOOK ON NORTH AMERICAN MANUFACTURING

“We need to reshore manufacturing and supply. It will increase high paying, skilled jobs, and create an exponential number of support jobs.”

“Sufficient technology exists today to allow for remote working and production automation to accommodate new changes for workplace standards.”

“This event has prepared us for this response in the future. Being prepared is 95% of the outcome.”

“The impact has been severe and recovery will take many years, but over time manufacturing will get back to pre-coronavirus levels. One tailwind will be the transition of the supply chain to North America from Asia which will boost manufacturing and logistics capabilities.”

“Dealing with a crisis is never easy, but it will also force you to come up with outside-the-box solutions and grow stronger as an organization.”

“The impact of COVID-19 was a wakeup call about preparedness, market-positioning, and operations for many less established. Those lessons will likely redistribute business, vectorally diversifying the market, encouraging more sustainable operations, increased collaboration, and inter-regional referrals.”

“We will recover but will take months to years to get back the revenue lost during this time.”

The Need for Skilled Labor and Apprenticeships

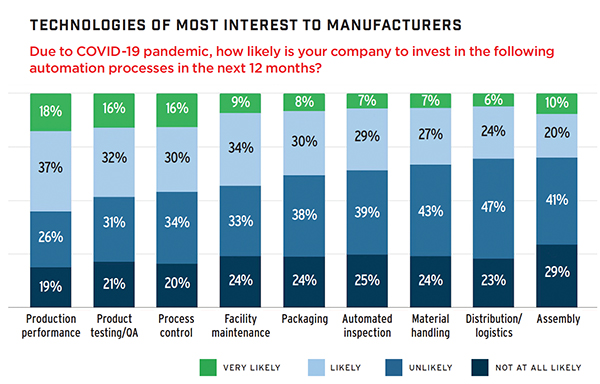

Automation + Technology Accelerate

The Impact of Automation in Times of Crisis

“[Automation] will allow for employees to more effectively use their time completing high value process work, while the lower value and higher time-consuming processes are automated.”

“We have used AR to avoid sending technicians to customers in infected areas.”

“Robotic systems give us more productivity and zero rejects. Faster product assembly for an increase of finished products by 25%.”

“Automation has helped us to meet the ever increasing shorter deadlines within the entertainment industry. Fifteen years ago our lead times were six to eight weeks and longer.”

“We have been updating our processes, equipment, and software for years and found as a result that all but the shop floor can efficiently work remotely, keeping any work in progress moving forward and potential jobs available for estimating completed on time.”

“COVID-19 was an eye opener for us about the position and rate of adoption of automation in businesses similar to ours across the nation.”

Digital Marketing

Challenges with the Cancellation of Trade Shows

“We are emphasizing webinars right now when customers want to know more about a product, but look forward to getting back to trade shows and business travel when it appears safe to do so. We are also engaging our outside sales reps in social media more. Since they have spent less time on the road they have more screen time and have been good about sharing which increases our exposure exponentially.”

“Additional phone calls, virtual visits, social media, email blasts.”

“It is pretty bleak actually. We have been calling and sending emails but it is not producing results.”

“Case studies and articles published in trade magazines.”

“Our products are very hands-on. Without trade shows it will be challenging.”

“A more proactive initiative to reach out to the very healthy database of existing clients we already have. Reaching out and engaging the procurement departments on a more personal level and [on a] regular basis.”

“Pivoting from B2B to consumer markets.”

SOURCE: https://business.thomasnet.com/covid-19-survey-reports