U.S. Site Selection: How to Know Where to Go

Finding the right location to grow your distribution or manufacturing network can be tricky. Here are 8 tried-and-true tips to get you to the right place.

If you need proof that, as the ancient Greek philosopher Heraclitus said, “Change is the only constant,” look no further than the logistics sector. Both internal changes to a company’s business model and external forces putting pressure on varying aspects of the supply chain cause corporate leaders to continually evaluate and change their distribution goals and networks.

Add in a pandemic and two wars and you’ve got the ingredients for the massive disruptions we’ve seen during the past few years. All these changes can cause headaches and sleepless nights for anyone charged with deciding where and when to develop a new manufacturing facility, warehouse, or distribution center—whether on an entirely new site or by expanding an existing facility.

Yet, within the constancy of change, certain core principles don’t change much at all. Think of them as the best practices of site selection; they revolve around major influences including labor, transportation, and costs as well as less obvious factors like natural resources and even climate change.

We’ve rounded up eight crucial tips from the experts for considering how and where to place facilities to best serve your distribution strategy.

1. Gather Your Resources

Don’t try to make your decision in a vacuum. Numerous resources can help you with the process, including site selection consultants, community-based economic-development organizations, commercial real estate firms, and logistics experts.

Your company’s internal operating departments are also experienced at what works and what doesn’t work within your distribution network, and how to handle the financial aspects of the decision.

Assemble a working site selection team that has both the knowledge and experience to conduct due diligence, vet every important site selection variable, analyze pertinent data, and agree on a solution.

2. Establish a Systematic Process

Decisions about where to locate facilities are determined by each company’s unique business goals, which means they vary depending on specific circumstances and objectives, notes Christopher Steele, president and CEO of EBP-US, a business consulting firm based in Boston.

Steele adds that site selection decisions typically involve at least the following four steps:

- Define the company’s business strategy and the success parameters for the new or relocated facility.

- Develop the site selection criteria, usually phased in such a way as to allow a progressive evaluation from broad to specific, for example from country to region to community.

- Examine the communities and sites directly.

- Involve three to four sites and communities in detailed discussions and negotiations.

Site selection is “very much a systems exercise,” Steele says. “There is no one factor that determines it. There has to be a holistic answer that is good for multiple reasons.”

3. Build Consensus

Choosing intermodal-adjacent sites, like this CenterPoint Intermodal Center outside of Chicago, helps reduce drayage transportation costs and cut emissions.

Site selection can be completed within three or four months, whether you’re considering a new distribution center, warehouse, or manufacturing facility. Meeting that timeline, however, depends on first building consensus within your organization so that team members—even with some internal disagreement—are all ultimately on the same page.

Edward (Ned) Hill, professor of economic development in the John Glenn College of Public Affairs at The Ohio State University, proposes the following key 10 steps to build consensus:

1. Assemble your team (internal and consultant).

2. Define goals, objectives, and key operational concerns.

3. Establish consensus on steps 1 & 2.

4. Define your business model and corporate culture.

5. Create a project timeline.

6. Establish consensus on steps 3 & 4.

7. Identify factors and variables critical to the company’s success.

8. Establish consensus on step 7.

9. Rank the regions under consideration.

10. Establish consensus on step 9 before commencing to identify specific potential properties.

4. Consider the Labor Force

Deciding where to put your facility “starts and stops with one word—labor,” says Terry Coyne, vice chairman in the Cleveland office of Newmark, a global commercial real estate advisory and services firm. “Labor completely drives everything.”

Coyne points to Honda’s decision, in 2022, to build a $3.5-billion EV battery plant in the small town of Washington Courthouse, in Fayette County, Ohio. “The plant is not near much, but it is near a lot of labor,” Coyne says. And the new factory will need that labor to fill an estimated 2,200 new jobs.

In addition, Honda is retooling existing plants in Union, Logan, and Shelby counties for EV production, and adding another 300 or so jobs there.

Workforce issues are especially critical now. “It used to be power, utilities, the cost of construction, and incentives, but since the pandemic, it’s labor, labor, labor,” Coyne says.

Look toward markets with large university systems, which produce “a heavy pool of young labor, and that tends to attract employers,” he advises. These markets also fuel future growth. “People move to where the jobs are,” he says.

5. Know Your Customers

The three rules of real estate—location, location, location—still apply, especially if your customer base is regional and labor is local.

That’s why Camrett Logistics, a Wytheville, Virginia-based third-party logistics company, invested more than $2 million to expand its Dublin, Virginia, facility with new construction. It also renovated existing space and purchased new forklifts and electric trucks.

“We decided to invest in the community where we already have three buildings,” says Cameron Peel, president and CEO of Camrett. “We have a good brand and name in this community and are confident we can fill 58 jobs over the next 15 months. Having roots in southwest Virginia made it an easy decision for us to invest here.”

In addition, the company considered its customer base and the position that Camrett holds within their supply chains.

“Costs for customers go up if we are located in Timbuktu,” Peel explains.

The company did consider other locations in the Southeast, but higher construction costs intervened. “It was hard to justify putting $150 per square foot into the ground when it was $50 per square foot four years ago,” he says.

And, with their current location, “we are already in a sweet spot to get to New York City, Philadelphia, Washington DC, Indianapolis, Nashville, Atlanta, and the entire East Coast,” Peel notes.

“We can offer one-day trucking to more than 50% of the U.S. population without having to move,” he adds.

6. Leverage Existing Assets

RLS Logistics decided to expand its Newfield, New Jersey, cold storage facility to leverage its existing assets and remain in an area that is conducive to serving the East Coast market.

RLS Logistics, a New Jersey-based cold chain 3PL, also decided to increase operations in its existing area. In October 2023, it announced the opening of its expanded Newfield, New Jersey, cold storage warehouse.

“Our Newfield facility is a busy campus,” said John Gaudet, vice president of business development, in a statement. “Adding cold storage warehouse capacity here has been well received by current and new customers. We are well on our way to filling the space and moving new customers into our network.

“With increased cold storage inventory, enhanced capabilities in fulfillment, and LTL cross docking, this expansion is a great opportunity for the East Coast marketplace,” Gaudet added.

The on-site expansion gives customers access to RLS’ temperature-controlled freight brokerage and LTL shipping services and allows businesses to manage their cold storage needs and transportation requirements through one 3PL partner.

“This development provides growth opportunities not only in our cold storage business but also in our direct-to-consumer fulfillment and cross docking warehouse business units,” says Russell Leo, CEO of RLS Logistics.

7. Think Ahead

Adam Roth lives by what he calls “The Rule of 1.5.” The executive vice president of Chicago-based NAI Hiffman, an independent real estate services firm, says that transportation drives real estate.

“I have found that issues in this sector eventually impact industrial real estate about 1.5 years later,” he explains.

For manufacturing, the 1.5 Rule means estimating your needs for power, water, climate, and “an additional factor, which is the new COVID,” Roth says. In the coming years, power and water will become scarcer, and climate change will play a bigger role in where natural disasters are likely to be more severe, he notes.

He recommends looking to expand in states that are able to export power, which means they have excess power. “Few states do that,” he says.

Water is also more difficult to find, “but the Great Lakes contain 84% of the continent’s fresh water, 95% of U.S. water, and 21% of global water,” Roth says.

In 2008, the eight Great Lakes states signed the Great Lakes-St. Lawrence River Basin Water Resources Compact, which allows them to control the lakes’ water and keep it in the region, with limited exceptions. The states reached a similar agreement with Ontario and Quebec, Canada.

Regarding climate, Roth recommends looking at FEMA’s National Risk Index, which includes data on 18 natural disasters—including avalanche, flood, fire, and drought—to determine risk by region.

“The number of disasters causing more than $1 billion in damages is alarming,” Roth says. “If you’re going to spend $50 million-plus on a plant, those are consistent factors to consider in site selection.”

The factors affecting his 1.5 Rule are always changing, he says. But the new realities around power, water, and climate represent “the biggest changes in the past five years.”

8. Strike a Balance

While all real estate search requirements are unique, “site selection is generally a balancing act between real estate, labor, and transportation costs,” says Kristin Leffew, vice president, real estate at Kenco, a 3PL provider based in Chattanooga, Tennessee.

To reduce transportation costs, Leffew recommends strategically locating warehouses and distribution centers near the main mode of transportation for shipping/receiving and to your distributors, suppliers, customers, or manufacturing plants.

Locating in an intermodal-adjacent facility also provides benefits. “Transportation is 12-14 times the cost of real estate,” Roth notes. “By locating on an intermodal campus, corporations can directly impact their transportation spend by saving on drayage costs and carbon emissions.”

On average, the annual cost savings by locating at an intermodal center is “equivalent to 50% of a corporation’s rent depending on their intermodal volume,” he adds. “In addition, the CO2 savings are also measurable and perpetual due to the reduced drayage miles.”

Leffew also recommends the following tips for factoring transportation costs into site selection decisions:

- Research each potential area’s workforce availability, skill, and wages on the front end. Many real estate service providers now have integrated tools that consolidate building availability and rates, labor data and wages, transportation costs, and GIS mapping into one platform. The tool can offer a facility ranking based on key metrics the user identifies.

- With vacancy at an all-time low and rates at an all-time high, evaluate market rents compared to transportation costs; it may be less expensive to consider a nearby location. For example, surging rents in the Inland Empire in Southern California pushed many companies to Las Vegas and Phoenix, where average rates are considerably less.

Other important factors to consider, Leffew says, include state and local incentives that may help reduce upfront capital costs, investments, and ongoing taxes; and local, state, and federal regulations—building codes, zoning, environmental and safety regulations—that may impact the operation.

A new focus on micro-distribution plays a major role in which areas are gaining favor. “The pandemic took a knife to big retail, which has changed last-mile distribution tremendously,” says Christopher Steele of EBP-US.

With e-commerce’s emphasis on micro-distribution and fulfillment, Steele points to 24 locations in the United States that support 100% of last-mile distribution within 100 miles.

Yet, with all these recommendations, the right choice for any one company is always unique. “It depends on the company’s exposure and markets,” Steele says. “The obvious answer sometimes is not the right answer when you look at the specifics.”

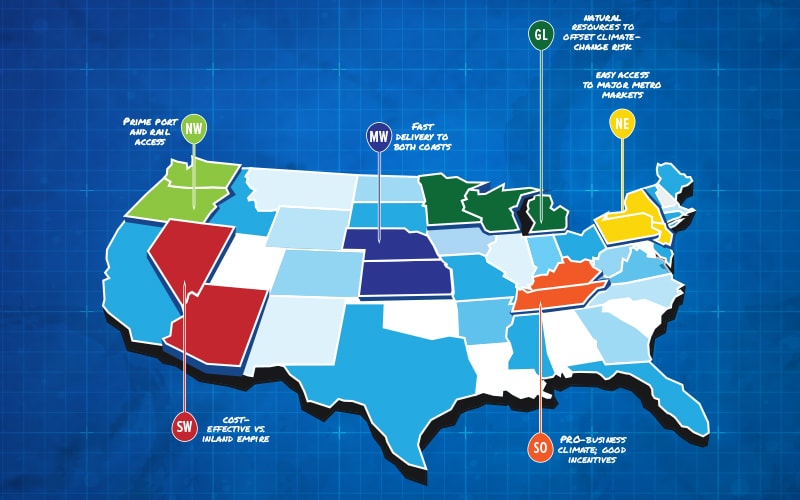

U.S. Hot Spots For Logistics Facilities

Where are the best and hottest places to expand your logistics operations? That depends on who you ask.

Perennial all stars include Atlanta, Chicago, Columbus, Dallas-Fort Worth, the Inland Empire of California, Las Vegas, Phoenix, Savannah, and New Jersey, according to Cushman and Wakefield’s Q3 Industrial Report, while Colliers’ 10 Emerging U.S. Industrial Markets to Watch in 2023 adds Austin, Charleston, Memphis, Raleigh-Durham, Reno-Sparks, Richmond, Salt Lake City, and Stockton/Central Valley of California.

In the coming fight for power, water, and climate safety, “Illinois, Pennsylvania, and the Midwest will thrive” in the manufacturing space, says Adam Roth of NAI Hiffman.

Newmark’s Terry Coyne picks Columbus, Ohio, as his hidden gem, because of its pro-business, incentive-heavy approach. He also cites Nashville, which has won site selection awards recently.

The Southeastern region “is rocking and rolling,” says Cameron Peel of Camrett, thanks to low wages and taxes, and a growing population.