Taking a Peek at Peak Season

It’s never too early to prepare for the holiday peak season, especially with disruptions mounting amid solid consumer spending. Shippers and carriers are employing automation, data-based decision making, and smart inventory management strategies—and tapping into lessons learned from last year—to get into position for 2024.

Now that the holiday season—and the resultant post-holiday “returns hangover” period—is behind us, retailers and analysts are reflecting on what transpired to determine lessons and trends for the 2024 holiday season.

One consensus is clear: The holiday selling season is getting longer. In 2023, consumers spent $109.3 billion online between November 1 and Cyber Monday on November 27—a 7.3% increase from 2022, Adobe Analytics reports.

Spending on Cyber Monday itself spiked as well, jumping 9.6% to $12.4 billion, according to the report.

Why the early start? Rather than forking over expedited shipping fees or risking out-of-stock issues, “consumers started their shopping with Black Friday, Cyber Monday, or even earlier,” says Ann Marie Jonkman, senior director, global industry strategy for logistics services with Blue Yonder.

The longer season isn’t the only important takeaway from the most recent holiday sales period. Here’s a look at some of the other trends:

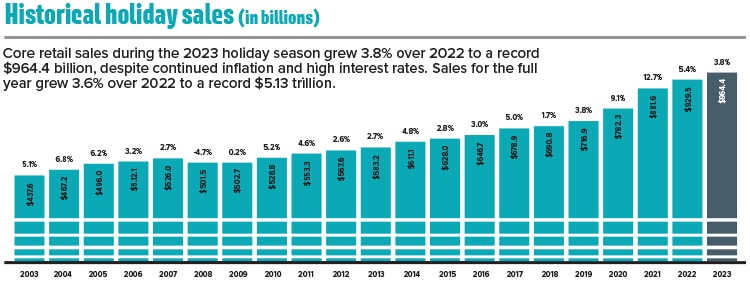

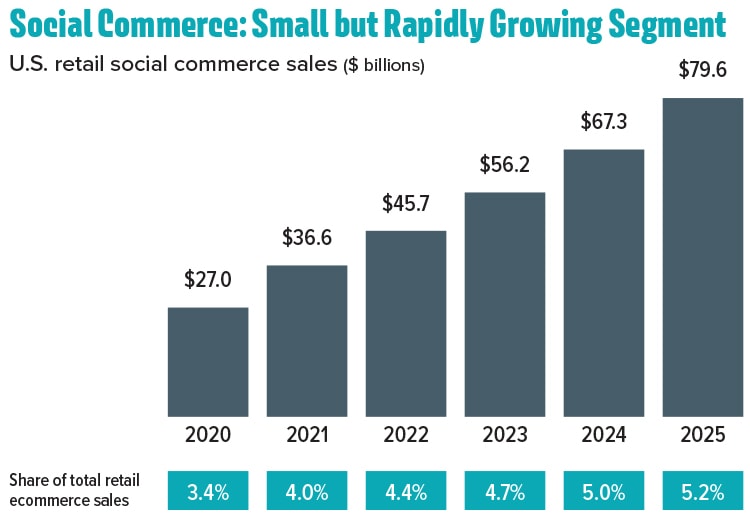

Continued strength in omnichannel retailing. Online and other non-store sales such as social commerce helped drive overall holiday sales growth in 2023, which jumped 8.2% to $276.8 billion, according to U.S. Census Bureau data, reported by the National Retail Federation (see chart). Social commerce—in which the shopping experience occurs on social media sites such as Facebook and Instagram—more than doubled between 2020 and 2023, hitting $56.2 billion, or about 4.7% of total retail sales, according to McKinsey.

Consumers are continuing in-store shopping as well, says Tom Wicky, co-founder and chief executive officer with MyFBAPrep, which provides logistics and other services to ecommerce retailers. Retailers and their suppliers need to invest in all the channels their customers are using.

Disruptions are likely to continue. The supply chain upheavals that have occurred over the past few years will continue to impact holiday preparations for the 2024 peak season. “We are living in a ‘not if, but when’ time,” says Brian Bourke, global chief commercial officer with SEKO Logistics.

For instance, the targeting of merchant ships in the Red Sea, as well as the drought at the Panama Canal, which is prompting authorities to reduce shipping volumes, will potentially impact air and ocean peak seasons all year long.

Amazon’s policies evolve. During the 2023 holiday season, Amazon doubled its Amazon Prime Day promotions and sales period from five to 10 days. “I expect that to happen again,” says Todd Phillips, vice president of agency operations with Run AMZ, which offers services for companies selling on Amazon.

Amazon also imposed several new fees on its sellers, such as a “low inventory fee,” intended to minimize out-of-stock situations.

Reverse logistics and cybersecurity are critical functions. Retailers anticipated customers returning approximately $148 billion in merchandise for the 2023 holiday season, equating to a return rate of 15.4%, finds a National Retail Federation and Appriss Retailer report. Of this amount, nearly $25 billion in fraudulent returns was expected.

Supply chain organizations that master reverse logistics and can head off fraud can gain a competitive edge.

Consumers remain interested in sustainability. Even during the holidays, a growing number of consumers consider the sustainability and environmental impact of the goods they purchase, says Satyendra Pal, global supply chain lead at digital consultancy Publicis Sapient. That’s especially true for younger consumers. Companies seeking to make the most of the 2024 holiday season would do well to remember this.

Moving Forward

With these takeaways in mind, how can shippers, carriers, and logistics providers prepare for a strong and smooth holiday 2024 season? Here are 11 actions to take.

1. Plan Early and Often

Source: National Retail Federation (NRF) and U.S. Census. Non-seasonally adjusted retail sales.

NRF holiday spending is defined as the months November and December.

NRF’s calculation of retail sales excludes automobile dealers, gasoline stations, and restaurants.

As the holiday season becomes longer and more vulnerable to disruption, starting holiday-focused supply chain planning and preparation earlier “ is a new best practice,” says R.J. Romano, managing director, management consulting, supply chain, with BDO.

For instance, PyroFarms, a company that grows and sells PyroDinos (bioluminescent phytoplankton that can produce light at night and fresh oxygen during the day) has become more strategic in planning for its holiday demand spikes.

Prior to 2023, the company began its holiday planning process in August or September. But in 2023, it began forecasting holiday levels in June, combining 2022 trends and current growth.

“This modeling allows us to order supplies sufficient for a strong holiday season while not extending our inventory beyond what is required,” explains Dean Sauer, PyroFarms’ founder and CEO. The early start also allows for more coordination with suppliers.

Through a different lens, a longer peak season can make operations more manageable. Buyers can try to space out their purchasing, so, for instance, they receive some inventory in early October and the rest in mid-November.

If demand spikes before the later shipments arrive, the company still might not be able to meet it. “Timing is a critical piece,” Romano says.

Scenario planning exercises are another important tool for early planning, where various stakeholders bring together data from across the enterprise to model “what-if” scenarios and identify gaps and risks.

Modeling the impact of an unexpected demand spike, for example, enables leaders to study the results and determine where to add supply chain redundancy to avoid being caught short.

Some companies have begun planning for the holiday peak as early as January, says Steve Sensing, president of supply chain solutions and dedicated transportation with Ryder. Ryder works with customers to prepare continual, rolling 12- or 13-week forecasts throughout the year.

This allows time to assemble resources—whether people or equipment—to assist in the flow of goods.

Given the Red Sea situation, the drought at the Panama Canal, and potential labor action at U.S. East Coast ports, importers and exporters need to prioritize contingency planning, adds Bourke. This includes considering alternate modes and routings, he adds, noting that companies are returning to sea/air and road/air solutions to help keep products moving.

2. Embrace Automation

Boosting efficiency through automation is important any time of the year. During the crush of the holiday season, it can become critical.

Take the example of Burlap & Barrel, a provider of single-origin spices: The company developed proprietary software that its two third-party logistics (3PL) providers can both access. The solution enables Burlap & Barrel to easily shift orders between the 3PL facilities and keep orders shipping out in time for the holidays, explains Ori Zohar, the company’s co-founder and co-CEO.

To accomplish this, Burlap & Barrel modeled its daily fulfillment needs based on its sales forecast and then matched it against each 3PL’s daily capacity. This data allows it to flag the days or weeks when one facility is likely to become backed up. When pending orders at a facility start to exceed daily capacity, the company shifts more orders through the other one.

3. Leverage Visibility

Visibility across an organization’s supply chain is critical for a smooth holiday season. “Visibility is table stakes,” says Jonkman.

Companies must go further yet: The key is using the information that’s now visible to take actions that can improve operations. One example is using the data to reroute goods that are delayed due to congestion or a snowstorm.

“The worst thing is to have great sales and delivery, but then have the product stuck somewhere in transit,” she says.

Combining visibility and collaboration also pays off. For instance, tools that allow operations and customer service teams at both shippers and logistics providers to collaborate can eliminate time-consuming calls and emails.

4. Make Data-Based Decisions

Leveraging technology to make data-driven decisions is another tactic to boost performance. For instance, analytics tools can detect unexpected demand shifts earlier so companies can respond quickly, leading to a nimble and resilient supply chain.

“Putting the proper data collection and analytics tools in place during the non-peak season is an essential first step in preparing for future busy seasons,” says Romano.

In addition, AI and generative AI can help plan for staffing needs and assess what-if situations.

5. Boost Inventory Management

The advent of the peak season should be a call to retailers to clear their distribution centers and stores of obsolete and burdensome inventory.

“Retailers must perform a delicate balancing act between creating space for seasonal products and streamlining operations for maximum efficiency and effectiveness,” explains Jeff Bornino, president, North America with TMX Transform, a supply chain consultancy.

Given the potential for ongoing disruptions, Wicky of MyFBAPrep recommends a sourcing approach that encompasses multiple different suppliers, even ones located in different regions of the same country.

He also suggests shifting from a just-in-time inventory approach to holding enough inventory to avoid going out of stock. That’s particularly true for online sellers, who may jeopardize their rankings on different marketplaces if they experience out-of-stocks.

Depending on how ongoing geopolitical events evolve, companies also may need to book orders earlier than normal to avoid transportation delays in receiving inventory.

6. Communicate With Business Partners

While communication among shippers, carriers, and freight forwarders is essential at all times, it’s becoming even more so currently, given the likelihood of disruptions continuing into the holiday season.

“Companies need to be very clear with how they see their forecasts changing,” Bourke says. He advises companies to provide forecasts early and often to all logistics and transportation providers, so they can safeguard space in their networks.

7. Monitor Amazon Policies

Companies that sell on Amazon need to consider the behemoth’s changing policies as they prepare for the 2024 holidays.

For instance, the fees regarding low inventory and aged inventory are designed to prompt sellers to manage their stock and sell-through effectively. “Amazon prefers items that don’t go out of stock,” says Phillips.

Supply Chain by Amazon—a fully automated set of supply chain services that helps sellers get products from manufacturers to customers across the globe—continues to expand. Among other functions, this service allows companies to ship inventory directly from overseas manufacturing into bulk storage, where it’s automatically pulled into fulfillment centers as needed.

Though “it’s hard to say if this development is good or bad,” notes Phillips, it is worth tracking for holiday 2024.

8. Nail Down Reverse Logistics

While returns can feel like a necessary evil, a smooth returns process can build brand perception and inspire goodwill and further purchases. Best practices include clarifying return policies and including a link to the policy in a website footer, notes Wicky.

Given the costs of handling returns, many retailers are testing different tactics to try to reduce the overall volume of returns. For instance, some are shortening returns periods or forcing shoppers to pay for shipping when returning certain items.

Over the past few years, some retailers have also experimented with ways to rein in returns abuse, including analyzing data to identify fraud and then charging extra to shoppers who abuse return policies.

9. Handle Fraudulent Orders ASAP

Along with sales, fraudulent orders tend to increase during the holidays. At Burlap & Barrel, for instance, the customer support team worked hard to verify potentially fraudulent orders, but didn’t have a great way to do it.

So, the company implemented an automatic order cancellation solution that cancels orders flagged for fraud risks. For example, fraudulent orders often come through one source in rapid succession, such as a new affiliate marketing partner that generates a handful of fraudulent orders. Automatically canceling the fraudulent orders saves time and helps avoid costly chargebacks.

10. Offer Options

Consumers want the ability to make decisions about their orders. This can include multiple delivery options, the ability to consolidate orders and reduce delivery trips, and the ability to pick up orders in a store, among other choices.

“It’s about choices and consumers will shop based on choices and values by that brand,” Jonkman says.

11. Learn to Operate with Uncertainty

Data for 2021–25 are projected.

Source: eMarketer

It’s impossible to predict exactly what holiday season 2024 will look like. Supply chain-dependent companies must be able to operate with some uncertainty.

“They can’t know for sure how demand will rise and fall, especially during busy seasons like the holidays,” Romano says. “But they can—and should—prepare in advance for influxes in demand during busy times.”