Strengthening the Port-Rail Connection

U.S. ports embrace rail connections through capital and technology investments designed to move cargo more efficiently and quickly.

The United States is home to more than 300 ports. In 2022, these ports handled nearly 43% of U.S. international trade by value, worth more than $2.28 trillion, the Bureau of Transportation Statistics reports. Waterborne vessels are the leading mode of transportation when it comes to product trade between the United States and other countries.

Once goods arrive at the ports, most need to move to markets farther inland. Rail can move many types of cargo quickly, efficiently, and with fewer emissions than most over-the-road options. Around half of rail intermodal volume consists of imports or exports, according to the Association of American Railroads.

The benefits of rail and intermodal are gaining more importance as cargo volumes at many ports increase. For example, the number of twenty-foot equivalent units (TEUs) moving through the Port of Long Beach and the Port of Los Angeles is projected to swell to 41 million by 2040, up from 16.6 million in 2023, says Mario Cordero, chief executive officer with the Port of Long Beach.

“A reality for many port authorities is limited land,” Cordero says. “The question becomes, how do you get more productivity out of what you have?”

For the Port of Long Beach, a major element of the solution is on-dock rail, which enables it to move more cargo, more quickly and with fewer emissions.

Transporting cargo in ways that produce fewer emissions not only helps the environment, but it also improves the quality of life for those living near ports and roadways, says Doug Thiessen, ports and maritime leader in the western U.S. with HDR, an architecture and engineering firm. For most longer distances, rail is also more cost effective.

Investments Needed

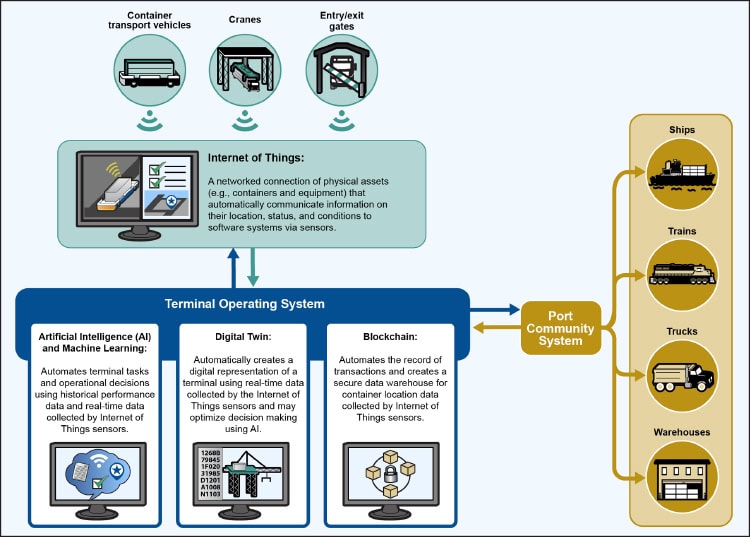

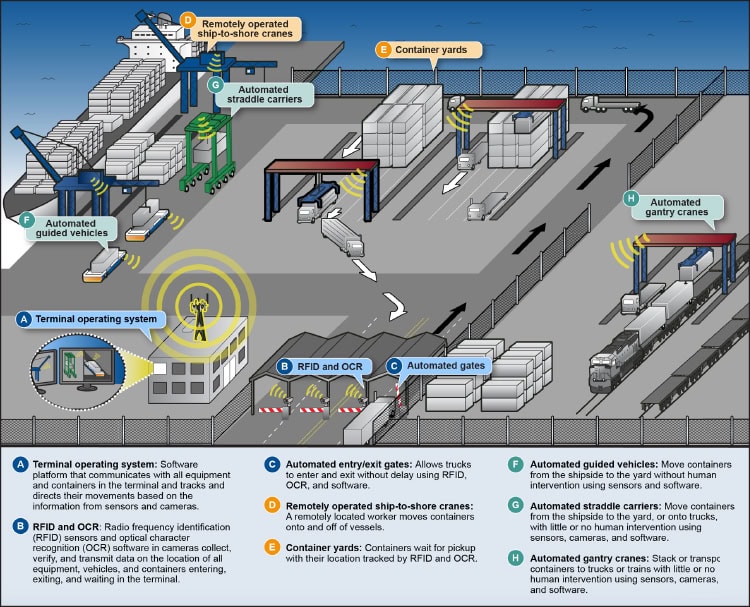

Process automation technologies reduce human involvement in optimizing, tracking, or communicating container movements within a port. For example, an automated gate system uses sensors to collect information from trucks and containers that pass through a port’s gates. Or, digital ledgers can record transactions and provide real-time monitoring of container location instead of a worker manually recording this information into a physical ledger.

Fully leveraging rail will require continued investment. Many on-dock intermodal rail yards were built when double stack trains were 7,500 to 8,000 feet long. Today, railroads can operate trains twice that length.

“Many ports’ intermodal rail yards are undersized and need additional and longer tracks, plus the capacity to manage and operate these railcars and additional locomotives,” Thiessen says.

Power switches, signals, and other types of equipment are also being designed to accommodate bigger trains.

Along with capital projects, investing in technology, such as automation and networking, is also critical. A March 2024 report from the U.S. Government Accountability Office (GAO) examined the use of process automation systems and automated cargo handling equipment at the 10 largest U.S. ports (see charts, next page). While all have adopted some of these systems, foreign ports have generally adopted more automation technologies.

A mix of reasons accounts for the generally lower investment at U.S. ports, says Josh Brogan, partner in the strategic operations practice of Kearney, a global management consulting firm. They can include labor agreements and laws that may date back centuries.

The GAO report cites the generally larger volumes of cargo handled at foreign ports, which lowers the bar to achieving a return on any capital investments. Shipment type is another factor. Foreign ports tend to have higher numbers of transshipments moving from one ship to another, rather than to rail or truck. That may make these ports more conducive to automation, as their operations are less complex than those at ports that move containers between different transportation modes.

Changes in Funding

Process automation technologies reduce human involvement in optimizing, tracking, or communicating container movements within a port. For example, an automated gate system uses sensors to collect information from trucks and containers that pass through a port’s gates. Or, digital ledgers can record transactions and provide real-time monitoring of container location instead of a worker manually recording this information into a physical ledger.

Funding for investments is also often challenging. “Through USDOT’s Consolidated Rail Infrastructure and Safety Improvements (CRISI) and Mega grant programs, our freight system and supply chain infrastructure have made many needed improvements over the past few years that America’s ports can be proud of and are grateful for,” says Cary S. Davis, president and CEO of the American Association of Port Authorities.

However, every port has unique needs and geographic constraints, and the grants tend to be over subscribed. “As we near the end of the Infrastructure Investment and Jobs Act authorizations, there’s no question that our ports would benefit from a more robust long-term commitment from our federal government partners to help finance upgrades for years to come,” Davis says.

Despite the challenges, many U.S. ports are making investments in multiple areas, including port-rail projects. The following projects are scheduled to come online in the next year or two, and will help shippers move their goods more efficiently and securely.

Georgia Ports Authority

The Georgia Ports Authority’s Mason Mega Rail Terminal at the Port of Savannah is the largest on-terminal intermodal facility in North America. Cargo moves from vessel to rail in 24 hours.

Network Georgia, an initiative of the Georgia Ports Authority (GPA), is establishing a series ofinland ports aimed at shifting long-haul truck routes to rail, eliminating millions of truck miles through the state each year.

Inland terminals allow cargo to be staged at the end customer’s doorstep, while the satellite rail ramps allow GPA to flow more cargo through marine terminals by providing additional container storage and freeing up capacity at the Port of Savannah, says Wesley Barrell, general manager of inland operations at GPA.

In Gainesville, Georgia, the GPA is constructing a second inland rail terminal, the Blue Ridge Connector (BRC). The facility will have a maximum throughput capacity of 200,000 containers annually.

The BRC will have capacity to store and operate 18,000 feet of rail cars on terminal, with the average length of the arriving and departing trains expected to be approximately 3,000 feet. It will be served by 14 rubber-tired gantry cranes.

When operations start in 2026, the facility will link northeast Georgia with the Port of Savannah’s 39 weekly global containership services. Shippers will no longer need to truck containers from this region of the state to the port.

Located along the manufacturing and logistics corridor of Interstate 85, the BRC will serve a region critical to the production of heavy equipment, and food and forest products. It’s also important for retail warehousing.

To cover the $134 million project costs, GPA invested $80.1 million. In addition, the project secured a $46.8 million grant from the Maritime Administration and $7 million from Norfolk Southern.

Port of Long Beach

The state-of-the-art Pier B On-Dock Rail Support Facility at the Port of Long Beach will move freight faster and more sustainably. It will double the size of the existing Pier B rail yard to 171 acres and more than triple the volume of on-dock rail capacity handled annually.

The biggest capital investments at the Port of Long Beach over the next decade will be improvements to the rail system, Cordero says. These changes will make it possible for a greater share of the cargo to move through the port via on-dock rail, or directly from marine terminals to trains.

The centerpiece project is the $1.57 billion Pier B On-Dock Rail Support Facility. The new Pier B, which is beginning construction, expands an existing rail yard where the switching railroad builds trains.

The project, which is expected to be finished by 2032, will double the yard from its current 82 acres, and will more than triple the rail yard’s volume to 4.7 million TEUs annually.

In the meantime, the $40-million track realignment at Terminal Island Wye will eliminate switching conflicts and boost efficiency, particularly at Terminal Island, which houses Pier T, the port’s largest container terminal. The project includes the construction of new tracks and the enhancement of a triangular rail junction where long trains can be turned and staged. It’s expected to finish this year, Cordero says.

In 2020, the Port of Long Beach was awarded a $14.5-million grant from the U.S. Department of Transportation’s Maritime Administration to help fund this project. The port itself was expected to cover the remaining project cost of $25.5 million.

Another project is the removal of a bottleneck through the Fourth Track at Ocean Boulevard, which was completed in 2023. In 2022, the port completed the $35 million Pier G-J Double Track Access project, adding a second rail line of 8,000-feet between two major piers.

“These projects are already generating results,” Cordero says. During the first half of 2024, the port moved 25% of cargo using on-dock rail, 6% more than in 2023. Average rail dwell time in July 2024 was four days, compared to 16 days during the supply chain disruption in October 2022.

Port of Los Angeles

A $52-million project to improve on-dock rail capacity at Pier 300 at the Port of Los Angeles will add new loading and unloading tracks to increase efficiency and reduce emissions. (PHOTO: COURTESY OF PORT OF LOS ANGELES)

The Port of Los Angeles has multiple rail-related projects underway or about to start. In July 2024, the port completed construction on a $73-million rail expansion project on Pier 400. The project included the addition of 31,000 linear feet of track, with five new railroad storage tracks; a concrete rail bridge with lighting; an asphalt access roadway; and new crossovers and turnouts, along with other changes, says Eric Caris, director of cargo marketing.

The project also relocated a portion of the lead track onto the Port of Los Angeles property, realigned the track connection to the rail storage yard, and relocated the at-grade crossing from Nimitz Avenue to Reeves Avenue, among other changes.

By increasing use of the Pier 400 on-dock rail yard, the project will create additional rail capacity. The expanded rail yard is projected to eliminate an estimated 1,200 daily truck trips by 2040, Caris says.

To help cover the costs, the port received a $21.6-million grant from the California Trade Corridor Enhancement Program (TCEP). The port funded the remaining cost of nearly $51.6 million.

Along with infrastructure enhancements, the Port of Los Angeles is investing in digital tools. The Port Optimizer, a cloud-based information portal that digitalizes maritime shipping data, enables shippers, cargo owners, terminal operators, and others to better predict and plan cargo movement, and to respond to issues more quickly.

In July 2024, the Port of Los Angeles announced it had been awarded $8 million from the California Governor’s Office of Business and Economic Development to accelerate Port Optimizer technology. The grant will provide funding to develop a new California Ports mobile application. This will make it easier for California ports to send and receive data on issues such as cargo status, Caris says.

Another enhancement will be the addition of an online gateway for collecting the carbon impact of port operations. Users will be able to access a near-real-time Green Asset Score based on rail, trucking, vessel, and on-port equipment particulate and greenhouse gas emissions. Based on this score, Port Optimizer users can select routes that balance cargo speed and emissions impacts.

Port Authority of New York and New Jersey

One of many projects underway by the Port Authority of New York and New Jersey is the Southbound Connector. This will add a second egress point to the ExpressRail Elizabeth terminal. Currently, trains can only exit the facility’s terminal to the north.

“Right now, trains go north to go back south. We want to streamline that,” says Nicol Polidoro, manager, multi-modal logistics.

This investment will increase operational efficiency and is expected to streamline train movements and reduce congestion during peak hours. ExpressRail connects every major container terminal in the complex with Norfolk Southern and CSX

The Southbound Connector project received $6.85 million in grant funding from the New Jersey Department of Transportation for planning and construction. It’s also funded in part by Maher Terminals and APM Terminals, which together operate the facility through their Millennium Marine Rail joint venture.

South Carolina Ports

Growth at South Carolina’s two rail-served inland ports has driven the percentage of containers moved inland by rail back up to pre-pandemic levels, with 23% of total marine containers traveling by rail during calendar year 2023.

South Carolina ports currently don’t offer an on-dock or near-dock rail option at their ocean terminals, says Laura Clifton, spokesperson with South Carolina Ports Authority. That will change when the Navy Base Intermodal Facility (NBIF) opens in June 2025. It will have a lift capacity of one million and the ability to handle more than 14,000-foot trains.

“This will be a busy facility once it gets moving, and we’ll be able to serve customers more efficiently,” Clifton adds.

The NBIF also will have 78,000 linear feet of railroad track, as well as six rail-mounted gantry cranes to move containers on and off CSX and Norfolk Southern trains. These two lines will serve the NBIF, creating a direct connection between port terminals in Charleston and inland ports in Greer and Dillon, as well as to markets in the Southeast and Midwest.

A dedicated drayage road, one mile long, will connect the NBIF to the Leatherman Terminal, providing a way to move cargo more quickly from the dock to the rail and on to inland markets.

In addition, a future barge will transport containers between the Leatherman and Wando Welch terminals. The overall project budget is about $550 million.

Another project is the $5 million, five-year expansion at Inland Port Greer. In 2022, 8,000 additional feet of track were added. The expansion of the west yard was completed in spring 2024, and the east yard expansion is slated to be complete by fall 2024, Clifton says. The new terminal operations and maintenance building will be completed in spring and summer of next year.

“We’ve seen a lot of success with our inland ports,” Clifton says. Inland Port Greer moved 175,873 containers on and off trains in 2023, a 26% jump from the previous year. Once it’s complete, the expansion will provide enough additional capacity to meet projected cargo demands through 2040. “Rail helps us get things off the dock and inland to our inland markets much more efficiently,” Clifton adds.

Top 10 U.S. Ports by Volume (2023)

1. Port of Los Angeles, California

2. Port of New York/New Jersey

3. Port of Long Beach, California

4. Port of Savannah, Georgia

5. Port of Houston, Texas

6. Port of Oakland, California

7. Port of Virginia

8. Port of Charleston, So. Carolina

9. Port of Seattle, Washington

10. Port of Miami, Florida