Latin American Logistics: The View to the South

Opportunities abound for U.S. companies selling in and sourcing from Latin America. But trade can be tricky. Partnering with experienced logistics and transportation service providers is often the way to go.

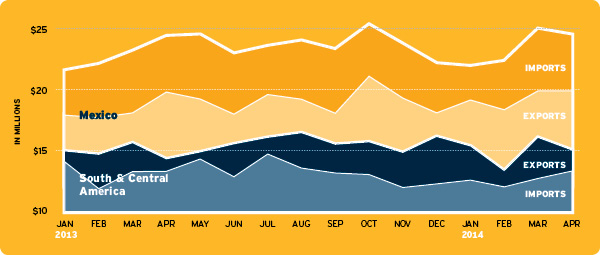

Booming Business: U.S. Trade with Latin America

If the U.S. Department of Commerce (DoC) gets its way, more cargo will be flowing south through the Western Hemisphere in the coming years. In January 2014, the DoC launched a program called Look South, designed to encourage more U.S. companies to do business with Central and South America.

Fifty-eight percent of U.S. companies that export product do so to just one country—usually Canada or Mexico, according to Secretary of Commerce Penny Pritzker. But they would do well to extend their gaze farther abroad, she says.

"Now is the time for a Look South initiative to help businesses across the country explore Latin America’s expanding markets, learn about emerging opportunities in the region, and tap into federal programs that can help companies sell more products into the region, expanding their bottom line," Pritzker stated when she announced the new program at the World Affairs Council in Los Angeles in January 2014.

If you include Mexico, the United States already does a booming business with Latin America. U.S. businesses exported $226.2 billion worth of goods to its third-largest trading partner in 2013, and imported $280.5 billion worth, according to the U.S. Census Bureau (see chart, below).

Those numbers significantly outweigh the figures for trade between the United States and the massive territory stretching from Guatemala to southernmost Chile and Argentina. In 2013, U.S. exports to Central and South America totaled $184.3 billion, and imports totaled $158.4 billion, according to U.S. Census Bureau data.

No matter which region of Latin America a U.S. company has in its sights, opportunities abound for both selling and sourcing—and plenty of logistics and transportation service providers stand ready to smooth the way.

Miami-based Ryder System has been serving the demand for logistics services in Mexico—and across the U.S.-Mexico border—since 1994. As trade between the two countries heats up even further, Ryder is expanding to meet that growth.

Ryder’s largest Mexican presence is in Mexico City, Monterrey, and Guadalajara. "But we also maintain significant operations across border towns," says Gene Sevilla, Ryder’s vice president of international supply chain solutions. Those operations include facilities that help bring freight in and out of Mexico through Tijuana, Ciudad Juárez, and Nuevo Laredo, plus several smaller crossings.

The company has also planted its flag in several spots in the area known as El Bajío, at the geographic center of Mexico. Those locations include Querétaro, San Luis Potosí, Celaya, Salamanca, and Silao.

Within Mexico, Ryder provides warehousing—including value-added services such as labeling and kitting—and transportation management services. In addition, it manages cross-border loads that travel between Mexico and both the United States and Canada.

"We also offer line-feeding services for manufacturing plants in Mexico, managing and feeding inbound raw materials to the assembly line according to a production schedule," Sevilla says.

For automotive plants in Mexico, Ryder provides a yard management and rail switching service. "We handle all the rail operations inside those manufacturing complexes," Sevilla says. "We also handle new cars as they come off the assembly line. Ryder checks those vehicles for quality, then parks them in a storage yard. When the vehicles are sold, we either turn them over to local carriers who move them to dealerships in Mexico, or load them onto rail cars for export, primarily to the United States."

The automotive industry has long been a major driver of Ryder’s business in Mexico. Aerospace and industrial products are mainstays as well, but lately, Ryder has been handling a wider variety of cargo.

"We are working to expand our presence in other industries," says Sevilla. "The new areas of focus are consumer products, retail, and high-tech."

Among Ryder’s emerging services in Mexico is a crossdocking and transloading operation in the Port of Altamira, near the city of Tampico. This is in addition to the new operation in Celaya, and a crossdock in Culiacán.

"Ryder is continuing to expand its geographic coverage in Mexico," Sevilla says. "Some of these are small operations, but they have a big impact on our ability to serve shippers, because they allow us to provide reach to more locations at lower costs."

Growing interest in nearshoring—the practice of making products close to U.S. markets, rather than in Asia—is increasing demand for logistics services within Mexico and across the Mexico-U.S. border. "Because labor costs in Asia are increasing more dramatically than in the United States or Mexico, the advantage of manufacturing in Asia is eroding," Sevilla says.

To better accommodate the growing number of foreign companies opening plants in Mexico, the nation has gone on an upgrade spree. "We see the promise of infrastructure improvements at all levels, from the rail industry to highways to telecommunications," Sevilla says. "The Mexican government is investing significantly in all the elements required for effective and efficient logistics operations."

For example, in April 2014, Alejandro Fernández Campillo, general-director of highway conservation in Mexico’s Secretariat of Communications and Transportation (SCT), announced that Mexico would spend 65 billion pesos ($5 billion) in 2014 on highway construction, modernization, and conservation.

Such projects are good news for shippers trying to more efficiently move goods within Mexico. "All these infrastructure investments tend to hold down costs, and that is crucial for our customers and for the logistics sector in general," Sevilla says.

Brazil and Beyond

For clients of international third-party logistics company Agility, one big story in Latin America is the growing need for industrial products, including components, finished goods, and manufacturing equipment.

Much of that demand comes from Brazil. To help serve it, Agility operates a 110,000-square-foot warehouse in Miami. "We send freight from suppliers in different parts of the United States to Miami, consolidate it into containers, and export them by ocean or air to Brazil," says Nevino Rocco, vice president of sales and marketing at Agility Americas.

Traditionally, U.S. companies have shipped those goods from U.S. plants, or from U.S. warehouses that received product from contract manufacturers in Asia. But business in Brazil has increased so much that many U.S. firms now ship there directly from their Asian manufacturing sites.

In a change from past practices, many airlines now service Latin America directly from China, Hong Kong, Thailand, Taiwan, and Japan, says Jaan Roots, Agility’s director of trade lanes for Latin America. "Ten years ago, the air carriers would service the United States, then we would operate transshipment programs to get the freight to Latin America. That segment of our business is almost non-existent now."

Agility does handle intermodal transshipments, however—for example, freight that travels by sea from Asia to Los Angeles, then by truck to Miami, and by air to South America.

Most of the freight Agility manages in the Americas trade moves southbound from North America. "To a certain degree, Latin America is still an exporter of commodities, such as coal, oil, and grain," says Roots.

Companies shipping those products tend to work directly with carriers, rather than with third-party logistics partners. In the Americas, Agility mainly handles manufactured goods, such as chemicals, pharmaceuticals, and high-tech products.

Airfreight Fright

Capacity is plentiful for U.S. products moving to Latin America on the water, but air freight poses more of a challenge, says Roots. The problem doesn’t lie with passenger airlines that also carry freight; those maintain regular schedules and tend to leave on time. But some all-cargo airlines can be less reliable.

"We contend with airlines that cancel a flight, then use the plane to go to a different destination where they can get return loads," Roots says.

The biggest obstacle U.S. companies face in shipping to Latin America, however, is the need to meet complex documentation requirements. "Even countries operating under free trade agreements generate a lot of red tape," Roots says.

Regulations vary widely from country to country, and authorities sometimes change their minds about requirements at the last minute. "It’s important to double-check documentation requirements prior to shipment," says Roots. To deal with this challenge, and move freight efficiently into Latin America, it pays to have an office or reliable local partner in each destination country, he says.

Agility maintains its own operations in Brazil, Mexico, Peru, and Chile, and might soon open an office in Colombia. "In other countries, we rely on our active strategic partners," Roots notes.

As trade between the United States and Latin America continues to grow, Port Everglades, in Fort Lauderdale, Fla., is working hard to match it with increased capacity. Ocean carriers at Port Everglades currently provide service to Panama, Venezuela, Colombia, Guatemala, Honduras, Costa Rica, Brazil, Argentina, Peru, and Chile.

"In 2013, Port Everglades was number one in containerized trade with Latin America, with more than 400,000 TEUs, according to Port Import/Export Reporting Service data," says Steven Cernak, chief executive and port director at Port Everglades.

Exports from the United States to Latin America outweigh imports only slightly, at 52 percent and 48 percent, respectively. Companies that use Port Everglades to move containerized goods north and south within the hemisphere ship everything from produce, paper, and apparel to machinery, medical equipment, and auto parts. Tankers also use the port to move petroleum within the hemisphere.

Producing a New Commodity

Produce from Latin America could soon become an even more important commodity at Port Everglades, based on the success of a pilot program conducted by the Florida Perishable Trade Coalition. In October 2013, this group of businesses and government agencies, including the U.S. Department of Agriculture, started testing the concept of importing perishable fruit to the United States through South Florida ports.

To date, U.S. law has required such cargo to use ports above the 39th parallel, such as Philadelphia, due to concern about fruit flies and other insects that might threaten southern crops. That led to some circuitous routing—for example, for fruit from South America bound for markets in Florida.

"As new technologies become available, and as business reasons have changed over the years, it has become time to revisit and adjust those rules as necessary," Cernak says. So far, the program has imported grapes and blueberries from Uruguay and Peru through Port Everglades without any problem.

"The coalition will be expanding the program into 2015," he adds.

Port Everglades has ramped up its marketing efforts to encourage even more trade with Latin America. "We’re also helping existing customers increase the density in their yards," Cernak says. That means allowing them to fit more containers by stacking them higher.

In addition, the port will accommodate increased trade with Latin America by adding more berths, part of the Southport Turning Notch Extension initiative. The infrastructure project will extend the existing Southport Turning Notch—an area where containerships turn around—from 900 feet to 2,400 feet. With more space, the port can expand the number of berths in that section from one to six.

"We anticipate completing that project by 2017, including the berth construction," Cernak says.

Well before then, companies that import products from, or export to, Latin America will start benefiting from another infrastructure project at Port Everglades: the Intermodal Container Transfer Facility (ICTF). Built under a public/private partnership between the port, the state of Florida, and the Florida East Coast Railway, the new facility will open in July 2014. It will allow companies to transfer containers directly between rail and ship, or ship and rail, without the need for over-the-road drayage to an off-port rail yard.

"It’s the only facility of its kind in the United States," Cernak says. "It has both an international cargo gate, so port traffic can go directly onto rail, and a domestic gate, so local manufacturing also has rail access without going through the port complex."

The ICTF will allow shippers direct access to a larger portion of the U.S. population, Cernak says. That’s a particular advantage for shippers importing perishables from Latin America. "Cargo discharged at Port Everglades can now reach the hinterlands quickly and efficiently," he notes.

In 2013, exports to the United States’ 11 free trade partners in Latin America totaled $12.5 billion more than in the previous year, according to John Larsen, deputy director of the Trade Promotion Coordinating Committee Secretariat at the DoC’s International Trade Administration. As ports, 3PLs, and other service providers expand their efforts to facilitate that business, U.S. shippers can take advantage of new opportunities in their trade with nations to the south.

Booming Business: U.S. Trade with Latin America

Mexico leads the way as the United States’ top trading partner in Latin America. Other parts of the region represent expansion opportunities for U.S. businesses.

Note: All figures are in millions of U.S. dollars on a nominal basis, not seasonally adjusted unless otherwise specified. Details may not equal totals due to rounding. Source: U.S. Census Bureau