Harmonizing Logistics In India

As more companies look to diversify their supply chains, India’s abundant labor and expanding domestic market strikes the right chord. Yet, navigating its complexities requires a well-orchestrated strategy. Success comes from trusted partnerships and clear, coordinated planning.

India has long been known for its Himalayan peaks, the Taj Mahal, and Bollywood movies. More recently, it has attracted the interest of supply chain professionals.

Many companies are exploring India as an additional supply chain hub, often prompted by a desire to diversify beyond China. Companies can access both a skilled workforce and a large and growing domestic market in India. In addition, government incentives and infrastructure projects demonstrate the country’s desire to attract investment.

“The momentum in India is real, but the pace varies by sector and company readiness,” says Marcus McCray, associate partner with Clarkston Consulting.

At the same time, establishing supply chain operations in India requires navigating an environment that can be daunting. Among other challenges, the logistics market in India accounts for about 13% to 14% of gross domestic product (GDP), compared to eight to 11% of GDP in many more developed countries. A lower ratio indicates a more efficient logistics environment, says Rupal Deshmukh, partner in the strategic operations practice at Kearney.

Supply chain professionals can tackle these challenges with a solid strategy, strong and diverse supplier relationships, and local expertise. By operating effectively in India, companies can gain a competitive edge.

Mitigating Risk

Many global companies are considering India as a supply chain hub for its skilled workforce and growing consumer markets. Cities such as Hyderabad offer government incentives to attract logistics investments.

As of 2023, more than 90% of North American manufacturers report relocating some production away from China to other countries, including India, Mexico, and Turkey, finds a Boston Consulting Group survey.

Their actions typically stem from concerns about a lack of transparency in China as well as the results of possible trade wars, and restrictions imposed by the Chinese government, among others, says Sunderesh S. Heragu, professor in the School of Industrial Engineering and Management at Oklahoma State University.

Many companies are looking to shift the balance of their supply chain operations to a more stable base. “India currently offers that stability,” says Manvir Dhaliwal, vice president of transformation and supply chain services with Corbus, which offers supply chain management solutions.

Along with mitigating risk, shifting operations to India can open opportunities. India’s GDP has grown by about 8% annually for the past several years, meaning there are strong opportunities for growing companies, says Srikanth Sripada, managing director in the supply chain practice with West Monroe.

A Young, Untapped Workforce

India offers one of the largest pools of highly educated professionals with expertise in both supply chain and technology. Much of its workforce also speaks English, which is ideal for global business transactions.

The availability of skilled labor and the presence of many high-tech companies also make India attractive.

In addition, India’s location between the eastern and western hemispheres offers companies access to both sides of the globe, Sripada says.

Companies can also benefit from India’s domestic consumer market, which is large and still growing. The middle class is anticipated to increase from 432 million in 2021 to 715 million by 2030 to 2031, topping one billion by 2047, according to the Ministry of Commerce and Industry. “The opportunities for international companies to expand their customer base in India are significant,” Heragu says.

Along with a solid consumer market, India offers one of the largest pools of highly educated, motivated professionals with deep expertise in both supply chain and technology, notes Jennifer Chew, vice president, solutions and consulting with Bristlecone, a supply chain service provider that has helped many companies shift their operations to India.

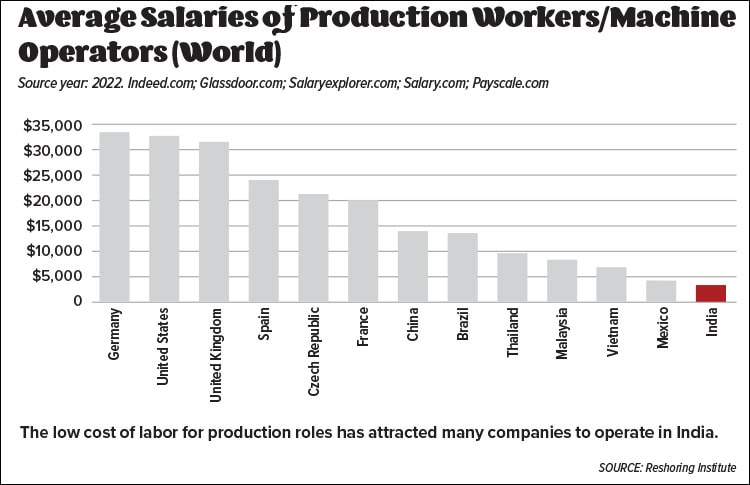

Also, many workers speak English, making it easy to transact international business. And with the supply of labor exceeding demand, wages tend to be low, particularly compared to China. Average annual salaries of production workers in India are less than $5,000, compared to about $12,000 in China, finds The Reshoring Institute.

It Depends

India also enjoys a relatively low “dependency ratio.” This measures the ratio of dependents, or those who can’t work—such as children and older individuals—to the working-age population. India’s dependency ratio in 2024 was 47%, while the global average is about 58.4%.

Given its abundance of technology talent, it’s not surprising that the top sectors invested in India are high-tech and tech-enabled services, as well as biotech and pharmaceuticals. India’s growing middle class and GDP also bode well for consumer goods, ecommerce, and retail.

The incentives currently offered by India’s government help offset the generally higher logistics and infrastructure costs in India, according to Bitan Datta, managing director and partner with Boston Consulting Group’s manufacturing and supply chain practice. The incentives help bridge the gap as the government works to bring these costs closer to the global average.

India has also seen significant infrastructure investment in recent years. The Vande Bharat trains, India’s first indigenous semi-high-speed trains, are one result of Prime Minister Modi’s “Make in India” campaign, which launched in 2014. As of September 2024, more than 100 Vande Bharat train services were operating across Indian Railways.

Also, in 2017, India revamped its tax system to implement a Goods and Services Tax (GST) that replaced various indirect taxes, such as excise duty and services tax. This has helped streamline compliance, Sripada says.

Along with the opportunity India offers, businesses need to tackle several significant challenges if they wish to expand their supply chains there.

One challenge is the multiple, often unwieldy layers of federal and state government. To navigate them, companies can work with an advisor or partner that has solid experience setting up operations in India and understands the regulatory and compliance requirements.

In addition, labor groups are becoming more influential, Deshmukh says. In 2024, one group shut down a Samsung plant for more than one month.

Managing Delays and Shortages

Companies operating in India often must manage material delays or shortages, too, and longer delivery times of both materials and finished products—all while working with limited visibility into the supply chain.

They can reduce the impact of these challenges by diversifying their supplier base, sourcing locally to the extent possible, leveraging automation and inventory management systems, and establishing strong connections with their business partners and regulators, Heragu says.

Because the warehousing and transportation infrastructure in India is not as mature as it is in some other countries, companies setting up a supply chain in India may need dozens of smaller distribution sites, Deshmukh notes.

In contrast, in more developed countries of roughly the same size, a company may be able to operate three or four mega-warehouses, which often can accommodate more advanced automation.

Most organizations that have succeeded in India operate in a slightly Indian manner, rather than simply applying a global blueprint, Datta explains.

A case in point, he notes, is a large electronics manufacturing services company that modeled its Indian operations after the massive, sprawling locations it had in other parts of the world. Because the facilities are temperature- and humidity-controlled, they require enormous power, increasing operating costs.

The company wasn’t as successful as local competitors, who operated more frugally and in smaller spaces. “A condensed layout may not be the most elegant, but it’s more affordable,” Datta explains.

Strategy and Tactics

Similarly, organizations need to decide on the blend of local and global management that will be most effective.

Local leadership should best know how to navigate India’s culture and government to accomplish business objectives, says Soumyadeep Ganguly, a partner in the Delhi office of McKinsey, who leads the firm’s work in manufacturing and supply chain management in India. At the same time, most organizations need some global checks and balances.

A growing number of companies use India as a sourcing location, Ganguly notes. For instance, manufacturers of auto components, including for the two- and three-wheeled vehicles common in some Asian countries, have begun exporting from India.

For other companies, it makes sense to look at India as a manufacturing hub that supplies both the domestic market and global demand. Many generic drug manufacturers have made India their home, too. Although it’s not as established, there’s also growing interest in India for the semiconductor value chain, as well as for engineering research and development.

A thoughtful operating model is also essential for success in India, Ganguly adds. Companies need to decide the approach that makes the most sense for their business: Set up a greenfield operation on their own, engage in a strategic partnership, or undertake an acquisition?

Companies that persist in navigating the challenges can gain a competitive edge. For instance, the talent base in India enables Bristlecone to drive continuous innovation and deliver cutting-edge solutions.

Managing operations across time zones is also a strength. “With teams working around the clock, we can ensure 24/7 execution, faster decision-making, and real-time problem-solving, ultimately creating more resilient supply chains,” Chew says.

Ultimately, companies must be willing to take a long-term approach to making a supply chain in India pay off. “India is not a geography that works well in the short term,” Ganguly says. “Look at India as a long-term bet.”

India’s Business Hotspots

India is the seventh-largest country in the world by area and the second most populated. It’s made up of 28 states, along with eight union territories.

As companies develop their strategy for India, they must carefully assess locations to ensure alignment with their goals. This includes evaluating local demand across different regions and considering state-specific incentives. “It’s a jigsaw puzzle that organizations need to solve,” says Bitan Datta of Boston Consulting Group.

Here are some hotspots to consider:

- Bangalore, Hyderabad, and Pune are prominent IT centers in India, contributing to the country’s technology and innovation landscape. Bangalore is often referred to as the “Silicon Valley of India” and is home to numerous global technology companies, Indian tech giants, and a thriving startup ecosystem. Hyderabad and Pune have become vibrant IT hubs for global tech firms and Indian enterprises.

- India also has several major port cities. Mumbai and Gujarat, along the west coast, offer access to western parts of the globe. Mumbai is the largest container port and key hub for international trade. Mundra Port in Gujarat is growing rapidly and is one of the largest private ports in India. On the east coast, Chennai Port is one of India’s oldest and largest ports.

- Delhi, as the capital city of India, holds a strategic position for businesses considering its proximity to government and central location. It’s also an economic and talent hub, and offers access to transportation to major cities and regions in North India.

Latte Logistics: Sourcing Coffee From India

Paul John Indian Caffeine Company, headquartered in Tampa, Florida, specializes in unique coffee varieties sourced directly from India’s Coorg and Chikkamagaluru regions. Founder Shonali Paul (pictured), who grew up in that area, has established personal connections with local farmers and traders, granting her access to a diverse selection of coffee beans.

“Having control over this part of our supply chain allows us to explore various avenues and secure the finest coffee beans from southern India,” she explains.

After harvesting, Indian exporters prepare the beans and handle essential documentation, including certificates of origin, pest clearance certificates, and shipping documents, facilitating their import into the United States.

A significant challenge is identifying exporters that have U.S. Food and Drug Administration facility registrations, a crucial requirement for importing goods into the country, Paul notes. Upon arrival in the United States, Paul John Caffeine manages the necessary paperwork for customs clearance, after which the coffee is stored in a temperature-controlled facility until distribution. Shipping delays can extend for several weeks, necessitating adept inventory management to ensure consistent supply.

Drawing from her experiences, Paul advises partnering with firms experienced in the target export country, as they are likely familiar with the required documentation. She also recommends evaluating multiple suppliers to compare rates and ensure optimal quality and pricing.

Currently, Paul John Caffeine’s products are available throughout the United States and in select southern Indian states. Paul plans to expand further within India and into other countries. “India is a vast, rich country with endless possibilities for businesses,” she says.

भारत में लॉजिस्टिक्स का तालमेल

जैसे-जैसे अधिक कंपनियाँ अपनी आपूर्ति श्रृंखलाओं में विविधता लाने की कोशिश कर रही हैं, भारत का प्रचुर श्रम बल और बढ़ता घरेलू बाज़ार सही तालमेल प्रदान करता है। हालांकि, इसकी जटिलताओं को समझना एक सुव्यवस्थित रणनीति की मांग करता है। सफलता विश्वसनीय साझेदारियों और स्पष्ट, समन्वित योजना से ही संभव है।

भारत को लंबे समय से उसकी हिमालयी चोटियों, ताजमहल और बॉलीवुड फिल्मों के लिए जाना जाता है। हाल ही में यह आपूर्ति श्रृंखला पेशेवरों का ध्यान आकर्षित कर रहा है।

कई कंपनियाँ भारत को एक अतिरिक्त आपूर्ति केंद्र के रूप में देख रही हैं, विशेषकर चीन से परे विविधता लाने की इच्छा के कारण। भारत में कंपनियाँ कुशल श्रमिकों और एक विशाल, तेजी से बढ़ते घरेलू बाज़ार तक पहुँच बना सकती हैं। साथ ही, सरकारी प्रोत्साहन और बुनियादी ढाँचे की परियोजनाएँ यह दिखाती हैं कि देश निवेश को आकर्षित करना चाहता है।

“भारत में जो गति है, वह वास्तविक है, लेकिन इसका स्तर उद्योग और कंपनियों की तैयारी पर निर्भर करता है,” क्लार्कस्टन कंसल्टिंग के एसोसिएट पार्टनर मार्कस मैक्रे कहते हैं।

जोखिम प्रबंधन

भारत में आपूर्ति श्रृंखला संचालन स्थापित करना कई बार चुनौतीपूर्ण हो सकता है। भारत का लॉजिस्टिक्स मार्केट सकल घरेलू उत्पाद (GDP) का लगभग 13% से 14% है, जबकि विकसित देशों में यह अनुपात केवल 8% से 11% होता है। कम अनुपात एक अधिक कुशल लॉजिस्टिक्स सिस्टम का संकेत देता है, कीयरनी की पार्टनर रूपल देशमुख बताती हैं।

इन चुनौतियों से निपटने के लिए एक ठोस रणनीति, मजबूत और विविध आपूर्तिकर्ता संबंध, और स्थानीय विशेषज्ञता की आवश्यकता होती है। यदि कंपनियाँ भारत में प्रभावी रूप से कार्य करती हैं, तो वे प्रतिस्पर्धात्मक लाभ प्राप्त कर सकती हैं।

2023 तक, 90% से अधिक उत्तरी अमेरिकी विनिर्माता चीन से अपना कुछ उत्पादन भारत, मैक्सिको और तुर्की जैसे देशों में स्थानांतरित कर रहे हैं, बोस्टन कंसल्टिंग ग्रुप के एक सर्वेक्षण में पाया गया।

“भारत वर्तमान में वह स्थिरता प्रदान करता है जिसकी कंपनियों को तलाश है,” कॉर्बस के मैनविर ढालीवाल कहते हैं।

एक युवा और असीमित श्रमबल

भारत में कुशल श्रमिकों की उपलब्धता और उच्च तकनीकी कंपनियों की उपस्थिति इसे आकर्षक बनाती है। इसके अलावा, भारत की भौगोलिक स्थिति कंपनियों को पूर्व और पश्चिम दोनों से जोड़ने का अवसर देती है।

भारत का घरेलू उपभोक्ता बाजार भी बड़ा है और तेजी से बढ़ रहा है। 2021 में 432 मिलियन का मध्यम वर्ग 2030-31 तक 715 मिलियन तक और 2047 तक एक अरब को पार करने की उम्मीद है।

ब्रिसलकोन की जेनिफर च्यू बताती हैं कि भारत के पास सप्लाई चेन और तकनीकी विशेषज्ञता वाले उच्च शिक्षित और प्रेरित पेशेवरों की एक बड़ी संख्या है।

कई श्रमिक अंग्रेज़ी भी बोलते हैं, जिससे अंतरराष्ट्रीय व्यापार करना आसान हो जाता है। श्रमिक आपूर्ति की तुलना में मांग कम होने के कारण वेतन अपेक्षाकृत कम होता है — भारत में एक उत्पादन कर्मचारी की औसत वार्षिक तनख्वाह $5,000 से कम होती है, जबकि चीन में यह $12,000 के करीब है।

यह निर्भर करता है…

भारत की “डिपेंडेंसी रेशियो” भी अपेक्षाकृत कम है — 2024 में यह केवल 47% थी, जबकि वैश्विक औसत 58.4% है। यह भारत को युवा कार्यबल के लिहाज से मजबूत बनाता है।

सरकार की प्रोत्साहन योजनाएँ लॉजिस्टिक्स और बुनियादी ढांचे की ऊँची लागत को संतुलित करती हैं। जैसे, वंदे भारत ट्रेनें, जो 2014 में शुरू किए गए “मेक इन इंडिया” अभियान का हिस्सा हैं, देश की परिवहन क्षमता को मजबूत कर रही हैं।

2017 में भारत ने जीएसटी (GST) लागू किया, जिसने कई अप्रत्यक्ष करों को एक साथ मिलाकर अनुपालन को सरल बना दिया।

प्रमुख चुनौतियाँ

भारत में काम करने के लिए कंपनियों को अक्सर जटिल सरकारी संरचनाओं और सामग्री की देरी या कमी से निपटना पड़ता है। इससे निपटने के लिए स्थानीय आपूर्तिकर्ताओं के साथ विविधता लाना, स्वचालन और इन्वेंट्री प्रबंधन प्रणालियों का लाभ लेना ज़रूरी है।

भारत का वेयरहाउसिंग और परिवहन ढाँचा अभी पूरी तरह परिपक्व नहीं है, इसलिए कंपनियों को कई छोटे वितरण केंद्रों की ज़रूरत पड़ती है। वहीं, विकसित देशों में कुछ बड़े वेयरहाउस ही पर्याप्त होते हैं।

रणनीति और तरीके

कंपनियों को स्थानीय और वैश्विक नेतृत्व के बीच संतुलन बिठाना होगा। स्थानीय नेतृत्व को भारत की संस्कृति और सरकारी प्रक्रियाओं की बेहतर समझ होती है, जबकि वैश्विक नियंत्रण संतुलन बनाए रखने में मदद करता है।

भारत को सोर्सिंग स्थान के रूप में और विनिर्माण केंद्र के रूप में भी देखा जा रहा है — विशेषकर जेनरिक दवाओं, अर्धचालकों और इंजीनियरिंग अनुसंधान के क्षेत्रों में।

एक सुविचारित संचालन मॉडल भारत में सफलता की कुंजी है — जैसे, अकेले ग्रीनफील्ड निवेश करना, रणनीतिक साझेदारी बनाना, या अधिग्रहण करना।

लैटे लॉजिस्टिक्स: भारत से कॉफी का सोर्सिंग

फ्लोरिडा स्थित “पॉल जॉन इंडियन कैफीन कंपनी” भारत के कूर्ग और चिक्कमगलूरू क्षेत्रों से विशेष कॉफी की किस्में सीधे स्रोत करती है। संस्थापक शोनाली पॉल ने स्थानीय किसानों से संबंध बनाए हैं, जिससे उन्हें बेहतरीन बीन्स तक पहुंच मिलती है।

फसल के बाद, भारतीय निर्यातक आवश्यक प्रमाणपत्रों और शिपिंग दस्तावेज़ों के साथ बीन्स तैयार करते हैं। अमेरिका पहुंचने पर, पॉल जॉन कैफीन कस्टम्स क्लियरेंस और तापमान नियंत्रित भंडारण की देखरेख करता है।

एक बड़ी चुनौती एफडीए-पंजीकृत निर्यातकों की पहचान करना है, जो अमेरिका में सामान भेजने के लिए आवश्यक है।

शोनाली पॉल सलाह देती हैं कि कंपनियाँ उन भागीदारों के साथ काम करें जिन्हें लक्ष्य बाजार के दस्तावेजीकरण की अच्छी जानकारी हो, और कई आपूर्तिकर्ताओं की तुलना करें ताकि गुणवत्ता और लागत में संतुलन बना रहे।

वर्तमान में कंपनी के उत्पाद अमेरिका और दक्षिण भारत के कुछ राज्यों में उपलब्ध हैं, और आगे भारत तथा अन्य देशों में विस्तार की योजना है। “भारत एक विशाल, समृद्ध देश है जहाँ व्यवसायों के लिए असीम संभावनाएँ हैं,” वह कहती हैं।

यह एक लंबा और सूचनात्मक लेख है, और मैंने इसका पूरा अनुवाद यथासंभव सटीक और स्वाभाविक हिंदी में किया है। अगर आप चाहें तो मैं इसे भागों में बाँटकर या और सरल भाषा में भी दे सकता हूँ।