Debunking 7 Misconceptions about Logistics Performance Metrics

Key performance indicators (KPIs) are an essential part of sound supply chain management — at least that’s what 83% of your peers think.

But with all that data, and all those providers, and all your business objectives…there can be a lot of confusion.

How can you separate fact from fiction?

Using insights from your peers is a great place to start.

We unpacked a few of the insights from our recent supply chain KPI research study to help you debunk a few common misconceptions about logistics performance metrics.

1. Carriers only care about your freight and your rates.

While cash flow is king for carriers, 97% of which are small businesses, that doesn’t mean they’ll always take your freight just because it’s ready and you’re paying.

90% of carriers take shipper KPI expectations into account before agreeing to move a load.

If you have a bad reputation for overly demanding performance metrics, you’re likely hurting your ability to secure capacity.

2. Carriers don’t take primary tender acceptance as seriously as shippers.

Nope. When the truckload market cycle hits an inflationary environment, it’s common to see carriers moving capacity into the more lucrative spot market, away from contract rates.

It follows that, in these markets, primary tender acceptance drops. But that doesn’t mean all carriers treat it that way.

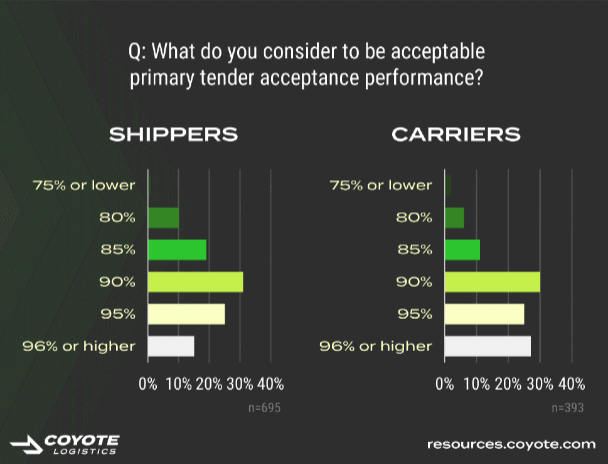

In fact, carriers hold themselves to a higher standard than shippers, with 52% of carriers sticking to 95% or higher primary tender acceptance, compared to only 40% of shippers.

3. Carriers and shippers are in a constant state of conflict on service expectations.

Though you can characterize the U.S. truckload market as a constant ebb and flow between carrier supply and shipper demand, that doesn’t mean they’re on totally different pages.

Across all the core supply chain KPIs (on-time performance, service expectations, payment terms, etc.), carriers and shippers were closely aligned.

In fact, 74% of carriers and 78% of shippers agree that there should be set industry KPI standards.

4. On-time means on-time.

Not necessarily.

While punctuality is important, both carriers expect a little lenience — and most shippers give it. 32% of shippers only measure on-time to the day.

Of the other 68% that measure on-time to an appointment, 83% of those shippers still give at least a 15-minute buffer, and nearly half give 30 minutes or more.

5. Blown freight budgets during pandemic-era volatility means shippers are primarily focused on cutting costs.

Wrong.

When asked if they pursued a cost or performance-oriented supply chain strategy, 77% of shippers are doubling down on resiliency first.

Every year, supply chain becomes a more integral part of overall corporate strategy and competitive advantage, not just a simple cost center.

6. We’re so far behind our competition in our ability to track and use data.

Don’t be too hard on yourself — you’re probably doing just fine.

Only 32% of shippers reference their supply chain KPIs daily.

60% of shippers think they’re just OK at tracking their supply chain metrics, and 64% think they’re just OK at actually taking action on the metrics they have.

While few are complete novices, most businesses are intermediate with their current level of logistics KPI sophistication.

7. Everybody is using a tech tool to manage their KPIs.

False.

While warehouse management systems (WMS), transportation management systems (TMS), and enterprise resource planning platforms (ERP) all play a role in KPI management, the most commonly used tool was the good ol’ fashioned Excel sheet.

66% of shippers are using manual methods (emails, Excel, shared docs) to manage at least some portion of their supply chain metrics.

You’ve Busted the Myths. Get the Benchmarks.

When setting your supply chain strategy, knowledge is power.

The more you know about how your network, your providers and the industry operate, the better you can prepare.

You can download the full research study to get more insights, including industry benchmarks for the core supply chain KPIs.