Supply Chain Strategies: How SMBs Can Compete with the Big Dogs

Supply chain technologies unleash the power that levels the playing field and lets small and mid-sized businesses scale.

In today’s highly competitive supply chain landscape, technology-based solutions are crucial to success. However, it can be difficult for small and mid-size businesses (SMBs) to afford and integrate the same sophisticated tools that their larger peers use, making it challenging for them to keep up with the latest advancements in the field and the efficiencies that they bring.

Still, smaller businesses hoping to scale to compete with large companies need to turn to technology to take that step.

Technology plays a vital role in helping SMBs compete with larger businesses in the supply chain. From cloud-based software solutions for order tracking to supply chain management platforms and robotics, technology can bring SMBs the efficiencies and insight that are necessary to thrive today.

“Technologies that democratize access to labor, supply, and logistics level the playing field for SMBs, in many instances allowing them to compete side by side,” says Raine Mahdi, CEO and founder of Zipfox, a California-based sourcing platform.

The key is finding solutions that are designed with SMBs in mind, allowing them to adopt and use tech tools without breaking the bank or over-committing precious personnel.

“Technology is such a huge piece of smaller businesses thriving, but it has to be the right kind of technology,” says Lior Elazary, CEO and co-founder of California-based inVia Robotics.

But many technology solutions are out of reach for small businesses, particularly those in the supply chain. “When you have fewer than 100 employees, where do you go?” asks Muffie Alejandro, president of Jan-Al Cases, a Los Angeles-based manufacturer of custom road and shipping cases.

In particular, small businesses do not have the volumes to attract competitive pricing for many solutions. However, conditions will improve for small businesses in the coming years.

“We’re about to go through a big revolution in technology that will make programs more accessible for small businesses,” Alejandro predicts. “Technology will begin to be available to assist the world’s smaller businesses instead of just the big companies.”

Tech Meant for SMBs

Small businesses that work with the major players in tech solutions can risk being overlooked, unable to develop productive relationships with providers and receiving limited support and cookie-cutter service.

“Working with larger providers may not be a great experience for a small business in terms of time and return on investment,” says Dennis Oates, chief logistics officer at Sendle, a shipping company focused on small businesses.

Large tech solutions providers may say they have a product designed for the small market but typically those products are not meant for true small companies.

“Bigger companies usually don’t understand the mentality of how a small company works,” notes Sam Polakoff, CEO and founder of BrillDog, which offers a supply chain management system designed for SMBs.

While vendors that serve large businesses naturally are going to emphasize those more lucrative clients, solutions providers that focus on SMBs have already committed to serving smaller businesses first.

The challenge that providers such as Sendle are focused on is how to provide small businesses access to the technology they need to compete.

“How do you level the playing field between what large customers have access to and what small customers have access to?” Oates asks.

For providers, serving SMBs may offer challenges, but it also is an approach rich with possibilities. Smaller businesses are often open to providers who can equip them with the same advantages that larger, more sophisticated shippers have.

“Small companies want to focus on the product they’re developing and selling,” Oates says. “They don’t want to be shipping experts. They’re ready for help.”

Automation and Warehouse Optimization

The pandemic and the accompanying explosion in e-commerce—alongside a widespread labor shortage—has made automation increasingly valuable to businesses, including SMBs, says Elazary.

Automation allows operations to do more with fewer team members—especially valuable in the current labor climate—and sharpen the performance of the staff who work in tandem with these tech solutions. Making the warehouse more efficient through automation and other tech solutions allows small businesses to concentrate on value-added services and building the business.

However, for small businesses, robotics solutions can be a strain on resources and an unproductive cost, Elazary says. A robotics-as-a-service approach can serve as a potential solution for SMBs, making it more viable and economical.

In that arrangement, a provider such as inVia maintains the robots and determines the appropriate number that a company needs to manage the volume of containers they need to move. Charges are based on the containers moved, ensuring companies pay for the work instead of the presence of the robots.

In this arrangement, both the vendor and the client invest in ongoing efficiencies rather than a vendor being incentivized to sell as many robots as possible, Elazary says.

Robotics-as-a-service is a business model “that’s very suitable for mid-sized to small businesses,” says Elazary. inVia focuses on robot productivity and not the quantity.

“It aligns incentives,” Elazary says. “I encourage mid-sized to small businesses to look at this business model, because it enables them to concentrate on their business.

“The customer is there to move containers,” he adds. “They’re not there to figure out how many robots they need and how to maintain them.”

Stronger Decision-Making

The technology marketplace offers an array of widely available platforms to SMBs that “play a dual role in not only providing accessibility to goods and services, but also simplifying historically complex processes,” says Mahdi.

For instance, cloud-based platforms help SMBs access freight forwarding and customs brokerage and have supply chain management tools to help track and manage orders. And platforms such as Upwork provide improved access to the global talent pool.

“For the first time, SMBs can recruit top talent and leverage their experience to grow their businesses,” Mahdi says.

Meanwhile, he says, Zipfox is democratizing access to supply, starting with Mexico, making it easier for small companies to use simple contract manufacturing in the country as an alternative to China.

“You don’t need to be a large business to capitalize on the resource next door,” Mahdi says. “You can make 100 pairs of jeans—it doesn’t need to be a full container.”

The need for small businesses to have access to alternative suppliers has been particularly stark in recent years with supply chain disruptions such as the pandemic, China tariffs, and Russia’s invasion of Ukraine.

A transportation management system (TMS) can help and is a crucial source of efficiency in the supply chain. But “the TMS field of players has exploded,” Polakoff says, and the array of options can be confusing for SMBs.

On the other hand, “one-off tools” to manage global product sourcing, purchase order management, inventory optimization, demand planning and other tasks can seem too costly or difficult to use, “and SMBs likely just won’t bother with it,” Polakoff says.

“They keep going along with what they’ve always done because that’s often the mentality of the small/mid-sized company: We know our product, we’re going to manufacture our product, and we’re going to keep enhancing and differentiating the product,” Polakoff says. “Where the supply chain is concerned, it’s just something they have to do.”

BrillDog aims to help SMBs find qualified vendors, issue and manage purchase orders, and have visibility to orders during the course of fulfillment or manufacturing.

“When products are ready to become freight—no matter where in the world they are moving—they are handed over seamlessly to a freight company or forwarder,” Polakoff says. “Documents are created, tracking is automatic, and everything runs smoothly.

“The key is making sure that we will solve a problem for the little guys that even the big guys can’t solve for themselves,” he adds.

Data is Key

Small businesses being able to analyze and use data the way large businesses can is key to competing with them. With business intelligence and artificial intelligence tools, “we can help companies make strategic and tactical decisions about their supply chain to save money and time,” Polakoff says.

Integrating most TMS software is costly—in both money and resources—creating challenges for SMBs.

“Everybody at a smaller company wears multiple hats,” Polakoff says. “They take on logistics or supply chain management because they have to. The company doesn’t have a lot of money to invest in software, they don’t have extra people, and they can’t hire third-party integrators. So they need a tool where they can perform the same supply chain functions as the big guys, but that they can use intuitively.

“Software needs to be intuitive, simple, and streamlined for the small company so they can get going the same day that they buy it,” he adds.

The Carrier Challenge

Large carriers in the United States mostly are focused on serving big companies with big orders.

“They design systems for large retailers and other organizations, and many times the needs of small businesses get left behind,” Oates says.

Sendle bills itself as the only carrier built for shipping packages for small businesses. Oates says smaller businesses often struggle to compete with larger competitors on shipping prices because they lack the same scale to help bring those costs down.

Sendle brings small businesses together to “change the power dynamic and help them get better rates together than they would on their own, while tapping into big business delivery networks,” Oates says.

Power in Numbers

Sendle integrates with existing large providers—such as eBay, Shopify, and other large e-commerce platforms—but aims to make the experience easier for small businesses than if they did it on their own. The company is designed to help SMBs find freight rates better than they could independently while providing a simple technology platform that allows them “to achieve the shipping that’s necessary to support their business,” Oates says.

“Small businesses value their time,” he notes. “They don’t want to invest a significant amount of time on shipping. They want to invest that time in product development.”

Technology platforms for SMBs in the e-commerce shipping space need to bring visibility to their supply chain with a simple, usable format.

“It’s about having a system designed for small businesses that allows them to get some of the features that many larger retailers have,” Oates says.

Easy Implementation

Some technology solutions for the warehouse come with prohibitive implementation costs for SMBs. For smaller businesses, tech solutions need to be readily implemented into existing facilities with existing staff members, allowing them to maintain business operations while they pursue improvements.

“The idea is to implement technology in the existing infrastructure while the warehouse is fully operational,” Elazary says.

The two most important characteristics that SMBs need in a technology solution are simplicity and affordability.

“Those are the two keys,” Polakoff says. “If they try it and get frustrated, they will leave it and never come back. And if it’s unaffordable, they won’t want to pass the costs on to their customers, and will just keep operating the way they always have,” he says.

When solutions providers can keep costs low, it lowers the barrier to entry for smaller businesses.

For example, “We configure the inVia system to address different businesses’ needs, but we try not to customize it too much,” Elazary says. “We provide the same solution to a lot of companies, and that’s how we can leverage and lower the cost,” he notes. “But at the same time, small companies also are benefiting from all of the latest tech that’s available. That makes a big difference.

“Looking for a partner that does that for you is extremely important to mid- and lower-end companies, because they don’t have the resources to create a solution from scratch,” Elazary says.

Choose Carefully

SMBs should take a clear look at their operations, their needs, and their capabilities before pursuing tech solutions so that they are deliberate in determining what they need and why they need it—and can make the best possible decision.

“In general, smaller businesses should be careful about overspending on technologies that don’t provide enough value,” Mahdi says. “There are a lot of options out there these days and more pop up every minute. Small companies need to be crystal clear on their goals and pain points, and then evaluate all the options before committing to a technology solution.”

What’s Ahead for SMBs?

2022 marked the third holiday season when small and mid-sized enterprises (SMEs) still dealt with the lasting impacts of the pandemic. From global supply chain disruptions to labor shortages and inflation, the holiday season created challenges for U.S. businesses.

However, the past three years have also resulted in some unexpected opportunities for SMEs, such as the dramatic increase in online shopping and e-commerce activity.

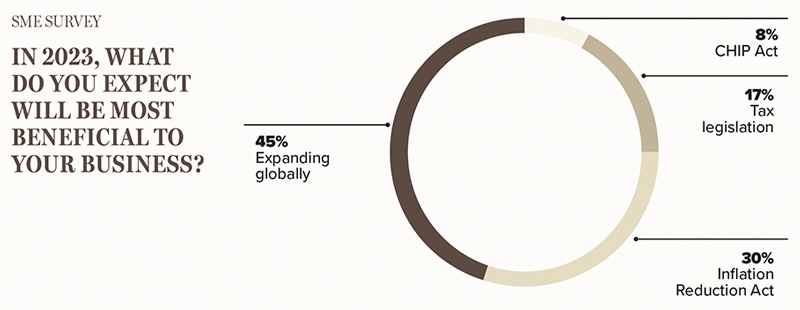

To gain insight into SME business expectations and outlook for 2023, DHL conducted a survey of U.S. SMEs. Here are the key findings, compiled from the nearly 2,000 responses.

Supply chain is the top challenge, but inflation is a close second. When asked about expected business challenges in the 2022 holiday season, 46% of respondents said supply chain delays were their biggest concern followed closely by inflation, which nearly doubled from last year with 35% saying it was their biggest concern in 2021.

Significant changes to year-over-year holiday sales were expected. Half of the respondents expected either significant increases or significant decreases to their business’ 2022 holiday sales compared to the 2021 holiday season. 27% expected a significant YoY increase while 23% expected a significant decrease. And despite inflation, 40% expected no significant change.

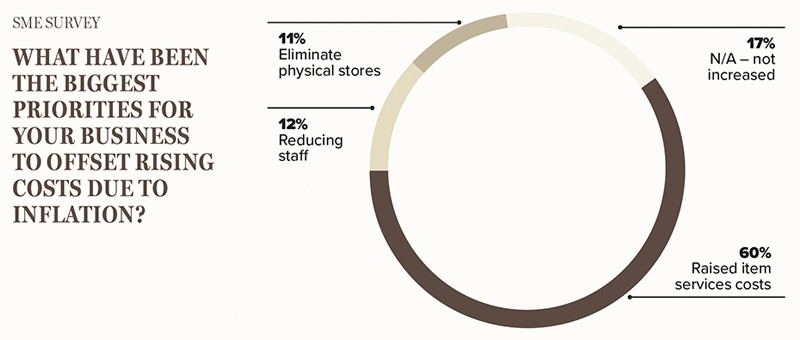

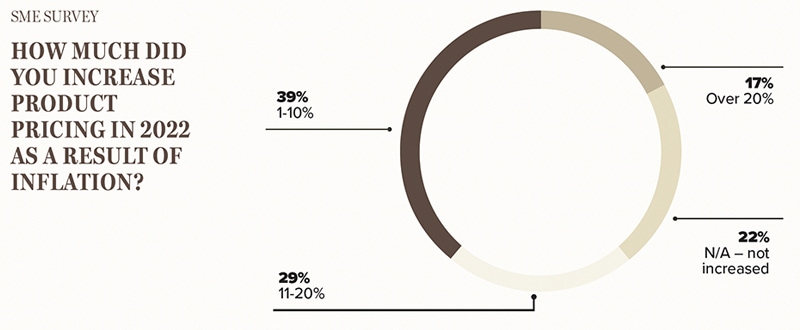

Inflation pressures are being passed down to consumers. To offset rising inflation, 60% said their biggest priority was raising the prices of their products or services. Furthermore, 78% of respondents have increased their product pricing due to inflation:

- 17% have increased their pricing by more than 20%.

- 22% have increased their pricing by 11-20%.

- 39% have increased their pricing by 39%.

The 2023 outlook is global. When asked what they think will be most beneficial to their business in 2023, almost half (45%) of respondents said expanding globally. Despite global trade challenges, SMEs are optimistic for expansion into new trade markets and are eager to reach new international consumers. 30% expect the Inflation Reduction Act will be most beneficial to their business in 2023.

Overall, the survey findings suggest that while challenges persist, a majority of SMEs are still optimistic about the global trade market going into 2023.