Beyond the Rack: Retail Supply Chain Strategies That Work

In the challenging retail sector, supply chain efficiency can be the difference between succeeding and just barely hanging on. From weaving together disparate systems into a single information flow, to ensuring products appear effortlessly on shelves, to fulfilling online orders with lightning speed, here’s how thriving retailers rack and roll.

The retail sector is tough. That’s true whether you operate brick-and-mortar stores, woo customers online, operate a subscription business, or engage in some combination of these.

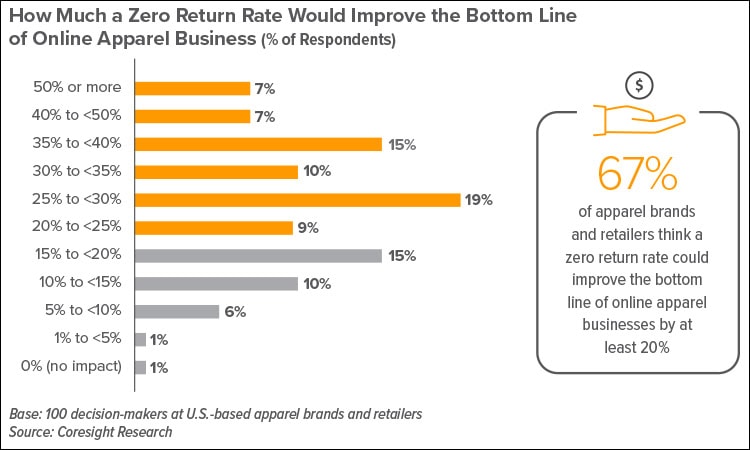

Two dozen retailers filed for bankruptcy in 2023, up from five in 2022 and 12 in 2021, BDO reports. Nearly one-quarter of apparel ordered online is returned, according to Coresight Research. And the average number of retail subscriptions held by subscribers dropped from 4.1 to 2.9 between March 2022 and February 2023, according to The Subscription Commerce Readiness Report.

Yet some retail companies are succeeding. They’re doing this by, among other steps, providing seamless customer experiences across all channels, gathering information from disparate systems, and adeptly managing inventory and supply chain operations.

Inventory Management

Inventory management has become more challenging as many retailers expand the number of suppliers they use, as well as the nodes from which they fill orders. Along with distribution centers, many now use brick-and-mortar retail locations, micro-fulfillment centers, and dark stores to fill ecommerce orders. This approach can speed delivery, boost the efficiency of last-mile logistics and offer better customer service, says Michael Needham, senior manager with Efficio, a procurement and supply chain consultancy.

There’s a downside, however: greater complexity. Countering that complexity typically requires creating one source of truth and a centralized means of understanding the company’s inventory, says Deanna Kaufman, vice president of product management with Körber Supply Chain Software.

The challenges around complexity become even more daunting when retailers offer products across multiple channels.

Say a retailer has to decide whether to show an ecommerce shopper that a T-shirt in one of its physical stores is available. First it needs to know the likelihood the item may actually be in the shopping cart of a brick-and-mortar consumer, says Roy Bridgland, senior industry strategies director with Blue Yonder, a supply chain platform provider. If the store has only several of a fast-selling item, it may make sense not to show the item to online shoppers.

To intelligently make these decisions, retailers need to link their systems, including their ecommerce platforms, as well as the ordering, warehouse, and transportation systems, Bridgland says.

Because any disruption or delay will have a knock-on effect, each link needs to be aware of any changes that might impact service.

Red Hot Kohl’s

New ecommerce fulfillment centers, equipped with automated storage and retrieval systems and goods-to-person technologies, enable retailer Kohl’s to fulfill orders more efficiently.

At Kohl’s, the $16.6-billion retail chain, supply chain and fulfillment capabilities continue to evolve as a core competency, serving both stores and ecommerce customers, says Gregg Barta, Kohl’s executive vice president, supply chain and logistics.

For several years, Kohl’s has been on a journey to introduce technology that improves the efficiency, quality, and speed with which it serves its stores and online customers, Barta says. Kohl’s six ecommerce fulfillment centers, 900-plus direct-ship vendors and more than 1,100 stores can provide same-day pickup and next-day or two-day shipping for more than two million items to the entire U.S. population.

Kohl’s opened a new ecommerce fulfillment center in Plainfield, Indiana, in 2017 and another in Etna, Ohio, in 2021. These new facilities “enhanced Kohl’s omnichannel capabilities with state-of-the-art technology to maximize productivity and throughput,” Barta notes.

Automated storage and retrieval systems (ASRS), and goods-to-person (GTP) technologies combine to eliminate handling touches and boost picking productivity when compared to Kohl’s generation-one facilities. ASRS and GTP bring items to associates, reducing the need for them to walk to pick orders, saving time and speeding the shipment of customer orders.

Robotic Process Automation (RPA) also helps by more efficiently managing the SKU (stockkeeping unit) assortment in stores and online.

Right-sized packaging technology creates custom boxes that are sized to the contents. This technology has slashed dunnage by more than half, Barta says.

The implementation of auto-bagger technology, which automatically bags ecommerce purchases, more than doubled packing productivity while improving outbound shipping efficiency.

“Our decreased use of packing materials and plastics is intended to reduce waste and use of landfills,” Barta adds.

Managing Inventory and Suppliers

Balancing inventory to meet customer demand without overstocking or understocking is a major problem, especially with fluctuating demand patterns within sectors such as apparel, footwear, and mass merchandise, says Sunny Zheng, an analyst with Coresight Research, which focuses on the consumer sector.

Retailers can use advanced analytics and artificial intelligence to forecast demand, optimize inventory levels and personalize the customer experience.

Also key is a multi-supplier sourcing strategy, says Johann Grassi, consumer industries leader with Syntax, a technology solutions provider. This mitigates the risk that comes with depending on a single supplier. With multiple suppliers, a customer is less vulnerable to delays due to natural or geopolitical events or system breakdowns that impact a single vendor.

Leather Skin Shop: A Data-Driven, Efficient Supply Chain

Leather apparel retailer Leather Skin Shop’s supply chain approach combines strategic partnerships, data-driven insights, and technology to navigate a competitive marketplace.

Leather Skin Shop sells ready-to-wear and customized leather apparel through its website. “Our commitment to a data-driven and efficient supply chain is a pillar of our success,” says co-founder Peter Martinez.

The company’s supply chain approach combines strategic partnerships, data-driven insights, and innovative software, all of which ensure agility and resilience, and help Leather Skin Shop thrive in a competitive marketplace.

Leather Skin Shop sources products from an established network of trusted suppliers in Pakistan and India. Building strong relationships with a select group of suppliers in different locations minimizes dependence on any single partner, mitigating risk, Martinez says. It also enables Leather Skin Shop to leverage each partner’s strengths and specialties.

For in-stock items, which account for about 85% of sales, Leather Skin Shop maintains a fulfillment center in Tualatin, Oregon. Custom-made products are crafted and shipped directly from the company’s workshops in Pakistan and India.

To prioritize responsive inventory management, Leather Skin Shop leverages Shopify, Google, and Microsoft Clarity. Shopify Analytics provides valuable basic traffic statistics. Google Analytics lets Leather Skin Shop analyze user behavior, track marketing campaign effectiveness, and gain insights into customer acquisition channels. Microsoft Clarity offers valuable visual recordings of user sessions, helping the company identify potential website usability issues and optimize the customer experience.

Another tool, Assisty, functions as an advance forecasting system that analyzes historical sales data and lead times. This allows Leather Skin Shop to identify items at risk of going out of stock within a specific timeframe, while also considering the 60-day lead time for shipment and storage in the United States.

“We can initiate timely replenishment orders and ensure products are readily available to meet customer demand,” Martinez says.

By deploying these tools and processes, Leather Skin Shop has enjoyed up to 70% year-over-year growth, he notes.

Signing up for Success

Along with the challenges that brick-and-mortar and ecommerce retailers must tackle, subscription businesses face a few more. For instance, “subscribe and save” offers on products consumers use regularly, such as shampoo, offer predictable cash flow and can be fairly straightforward to operate. Yet they still must navigate obstacles.

One obstacle is consumer fickleness. Many start a subscription, only to pause it months later. “It’s often not quite as predictable as a business might prefer,” says Robbie Baxter, founder of Peninsula Strategies, a consulting firm focused on subscription businesses.

In addition, different consumers will go through the same product at different rates. If the established rate doesn’t fit some consumers’ needs, they may decide to cancel.

Subscription boxes intended to delight customers with new products each month often encounter additional operational challenges. Baxter provides an example: A customer joins a clothing subscription service in June. Should she receive summer clothes or the popular basics, which aren’t seasonal? “It can become complicated with different rules for different people,” he says.

Involuntary churn, which occurs when a credit card doesn’t work, is a problem for more than the finance department. For example, a company knows 70% of credit card hiccups are resolved favorably within 10 days, yet it’s scheduled to ship a box in two days. Does it make sense to ship and potentially not receive payment? Or to wait and possibly annoy the customer?

One way to attract and keep a wider range of customers is to offer multiple subscription tiers. A business might introduce smaller product sizes, or entry, mid- and high-level versions. Tiers can address consumer sensitivity to pricing, which currently is a top challenge, says Paul Chambers, CEO and co-founder of the Subscription Trade Association (SUBTA), and CEO and founder of Core3 Solutions, parent company to Sip & Savor and other businesses. However, tiers boost complexity.

Many subscription services need to order products while they’re still estimating subscriber counts. By capping the subscriber count at a certain number and creating a wait list, subscription businesses can avoid overstocking, says Sarah Williams, founder and CEO of Launch Your Box, a resource for subscription businesses, and the subscription business, Framed!

One tool that can assist consumer-facing businesses, including subscription companies, is AI. “Retailers can use advanced analytics and AI to forecast demand, optimize inventory levels and personalize the customer experience,” Zheng says.

Getting Thrifty

Julia Meadows, founder of A Curated Thrift, says she’s looking into deploying artificial intelligence. Meadows launched her subscription business about five years ago, marrying her love for thrifting with experience in fashion styling.

Many people find buying secondhand or shopping in thrift stores overwhelming, Meadows says. She offers customers a complete, thrifted outfit every month or seasonally. The goal is to assemble outfits that fit a client’s style, personality, and body shape, so they’ll wear them month after month.

Because it’s a subscription service, Meadows can roughly plan out her supply needs for an entire year, which streamlines the buying process. So, if linen pants are forecast to be in style, she picks up enough for her customers. Once an item is purchased, Meadows logs it and assigns it a barcode.

As Meadows’ business scales, she’s looking into AI to help with the styling process, so she can devote as much time as possible to client service. For example, while Meadows might picture a peasant top with a billowy skirt, AI might suggest pairing it with a miniskirt, providing new ideas while also streamlining operations.

Critter Depot Gets the Bug

A subscription model helps A Curated Thrift (above) and The Critter Depot (below) better predict cash flow, plan out supply needs, and forecast order volume.

Optimizing a company’s distribution network by strategically holding inventory in various locations can improve efficiency and meet consumer demands for speed. For example, ecommerce company The Critter Depot breeds and sells live insects to reptile enthusiasts, pet stores, and zoos across the United States. When the management team noticed it had many repeat customers, it decided to offer a subscription model.

In addition to better predicting cash flow, a subscription model also helps forecast order volume. Crickets are sold in a variety of ages and sizes, and knowing the ones that will be in demand enables Critter Depot to keep them in stock.

During the pandemic, many local pet shops shut down and orders at Critter Depot surged. “This was great, but we could not handle all the sales,” says Jeff Neal, operations manager.

The team reached out to other insect farms. It still works with seven facilities to help fill orders, using technology to coordinate which facilities fill which orders. This can cut shipping costs, even as orders arrive at their destinations more quickly, which also boosts critters’ survival rates.

Collaborating with competitors has proven key to Critter Depot’s success. “Without working with competitors, we would never have been exposed to the idea of opening additional breeding shops,” Neal says.

Direct-to-Consumer Best Practices

As ecommerce sales have taken off over the past few years, a few direct-to-consumer capabilities have become “table stakes,” says Robbie Baxter, founder of Peninsula Strategies. These include free shipping for loyal customers, predictable delivery time frames, and easy returns.

With The Return Drop at Kohl’s, the retailer has expanded its successful partnerships for accepting returns at its stores. It now accepts returns from Carhartt, Hanes, and other brands.

Leather Skin Shop has taken several steps to ensure its direct-to-consumer interactions are as positive as possible. One is being transparent and using high-resolution product photos that showcase the leather’s inherent variations and texture.

Detailed product descriptions, highlighting the type of leather, construction methods, and care instructions also ensure customers make informed decisions.

Because customers can’t physically touch or try on leather goods they purchase online, Leather Skin Shop offers detailed size charts and fit guides, while design consultants help customers choose the right features for customized leather products. Return and exchange policies are clear and customer-friendly.

“Responsive and helpful customer service builds trust and encourages future purchases,” says Peter Martinez, co-founder.