3PLs: Responsive, Cost-Effective, and Green

The modern supply chain is complex, and in order for the world’s leading companies to deliver their goods and services in an expedient, cost-conscious, and environmentally friendly fashion, they are increasingly turning to third-party logistics (3PL) companies to achieve these goals. These are among the themes of the 2020 Third-Party Logistics Study, created and supported by Infosys Consulting, Penn State University, and Penske Logistics. Here are some insights gleaned from the 2020 3PL Study:

When shippers turn to 3PLs for supply chain improvements, what is their biggest need? That would be technology. Top 3PLs have already built out a robust tech infrastructure that contains the right tools for the job and best practices already realized by being field tested with an array of customers.

What are the top challenges in the modern supply chain? The study lays out a half-dozen common concerns: e-commerce growth; economic uncertainty following what is arguably the longest bull market run in the history of the stock market; the truck driver shortage; disruptive technologies (e.g., drones, automated vehicles, cloud-based capabilities); relationship necessities, namely supply chain alignment strategies; and competitive challenges.

How analytics fit into the supply chain. The five mostcommonly referred-to typesare:descriptive (explain what is happening); diagnostic (understand why); predictive (forecasting); prescriptive (suggest what should be done); and cognitive/artificial intelligence/machine learning to identify patterns of activity.

In the study, 95% of shippers and 99% of 3PLs agree that analytics are a necessary element of 3PL expertise. But, only 26% of shippers and 27% of 3PLs are satisfied with current analytic capabilities. The issues are based on ways to create clean and useful data, and insufficient resources to best utilize analytics (are there data scientists on the team?). This has created a large analytics gap that warrants further study.

Why is there an analytics gap? According to the study, a big roadblock is when the shipper and 3PL are not in total agreement on a strategic plan on the best use of analytics: What is the need and how to best serve it? It could be a battle of the old vs. the new. Many shippers currently employ legacy systems that are difficult to connect to today’s hardware and software. In general, the supply chain, like many areas of the business world, may be slow to adopt new approaches.

As geopolitical volatility affects global operations, supply chain finance is becoming critical. The survey reveals that 26% of shippers employ a supply chain finance professional at the vice president level; 31% report having someone with the director title. For shippers, the top supply chain finance costs are freight payment audit (72%), total landed cost (57%), and letters of credit (37%).

For 3PLs, top supply chain finance costs are freight payment audit (71%), letters of credit (39%), and open accounts (36%). The study also finds that 70% of shippers manage their impact of global political decisions internally, 20% aren’t managing it at all, and 19% use 3PLs to do so.

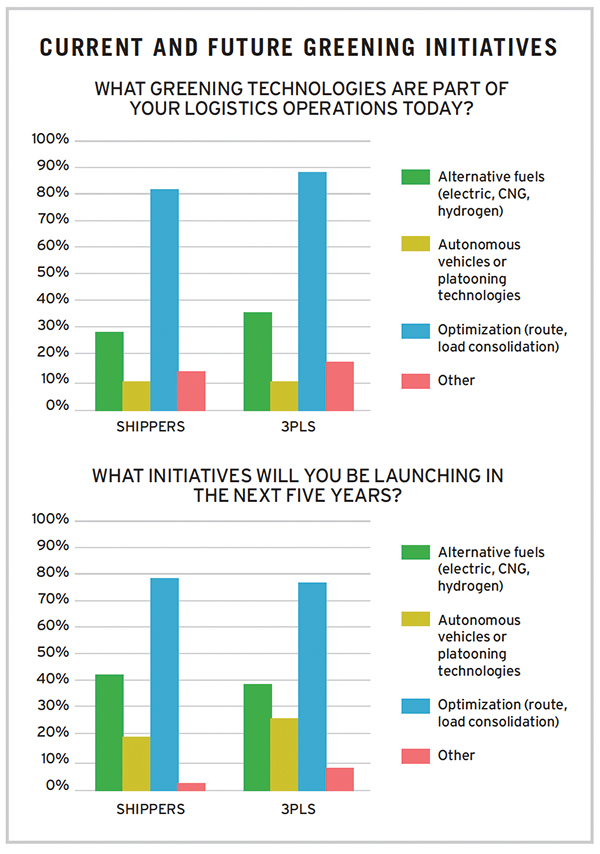

The greening of the supply chain continues. Why do shippers and 3PLs feel the need to introduce more sustainability into their supply chains? The top reasons are regulatory requirements, public perception, and cost savings.