3PL Perspectives 2020

In our 15th annual 3PL market research report, Inbound Logistics uses 2020 vision to see how the world appears today to shippers and their logistics service providers.

In 2020, as a pandemic sent the economy into a tailspin, industries struggled with supply disruptions and, often, with big swings in customer demand and transportation capacity.

About the 3PL Respondents

How to Find a 3PL-Third Party Logistics Provider

For many businesses, agility has become key. Companies that can modify their strategies quickly—sourcing from new regions, rerouting shipments, switching transportation modes, scaling fulfillment up or down, and securing the capacity they need to match those fulfillment plans—stand the best chance for success.

Maybe it’s that need to mount a nimble response that makes this otherwise perilous era a healthy environment for third-party logistics (3PL) providers. 3PLs that responded to Inbound Logistics‘ annual 3PL marketplace survey tell us they continue to take on new customers, bring in more revenue, and increase their profits—perhaps not at the same levels as in 2019, but still at a decent pace.

While shippers turn to 3PLs for assistance with challenges posed by COVID-19, they also rely on them to deal with issues that complicated their businesses long before the world went into quarantine. International trade disputes continue to pose supply chain risks. Fierce competition in the e-commerce and multichannel markets forces companies to figure out how to serve demanding customers faster and better. And, of course, companies always wrestle with costs as they work to improve the bottom line.

In Inbound Logistics‘ 15th annual 3PL Perspectives report, we gathered responses from both 3PLs and shippers and examined the forces that influence collaborations between them. We look at the challenges that shippers face and the services they need, along with solutions 3PLs provide—from transportation, warehousing, and supply chain strategy to information technology.

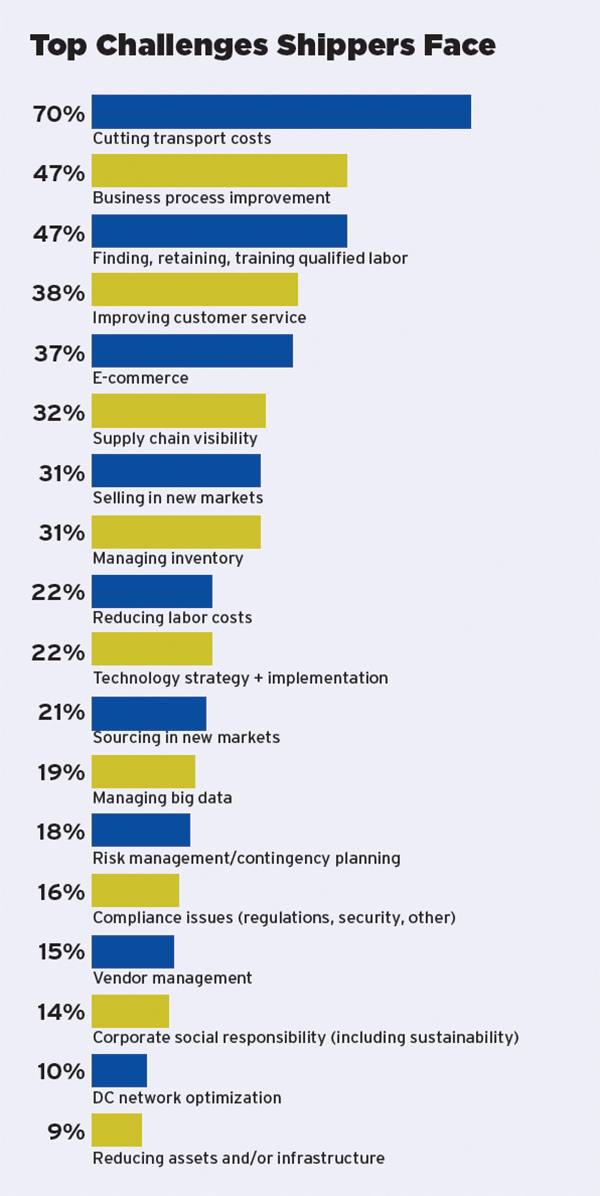

By far the biggest challenge for shippers who responded to the 2020 survey is how to reduce transportation costs with 70% naming it as a top concern. Nearly half of respondents are looking for ways to improve their business processes. The same proportion face challenges with finding, retaining, and training qualified labor—a big jump over 2019, when only 20% cited that challenge.

The next two biggest shipper concerns are improving customer service and managing e-commerce. E-commerce concerns come as no surprise, given the surge in online orders since the pandemic.

Other concerns have gained prominence since 2019. For example, just 8% of shippers mentioned managing big data as a challenge last year; in 2020 that number is 19%. And the proportion of shippers concerned with corporate responsibility challenges rose from 8% in 2019 to 14% in 2020.

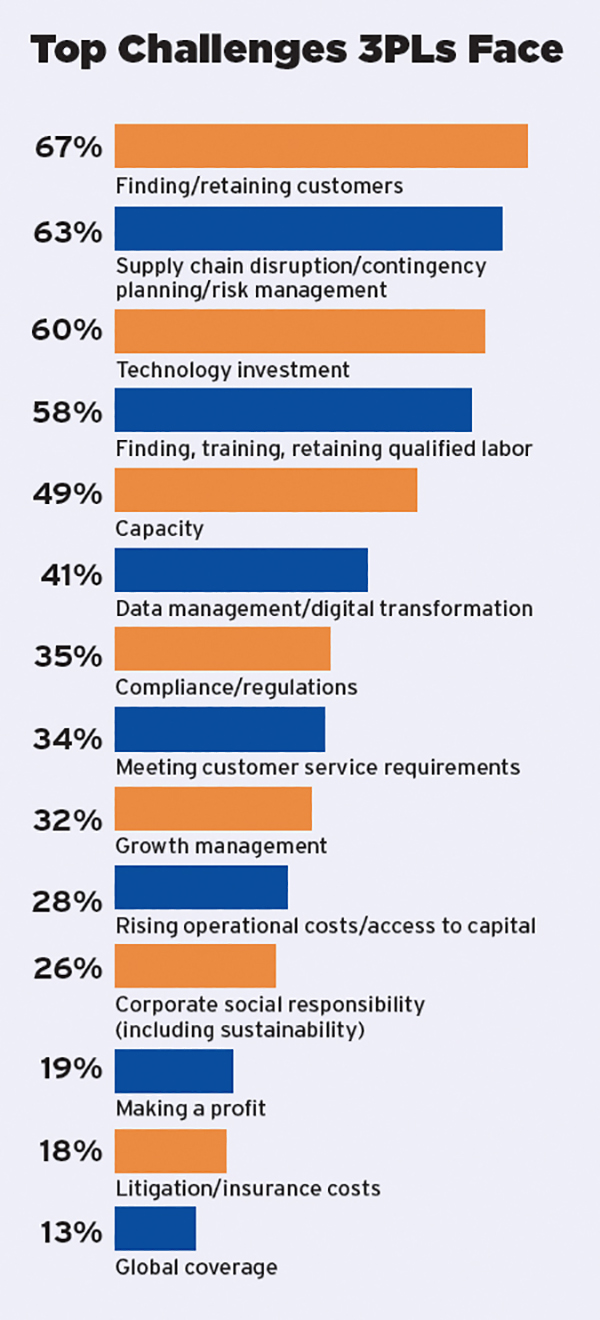

Four issues top the list of challenges that 3PLs face in 2020. The biggest is finding and retaining customers, mentioned by 67% of 3PLs that responded to our survey.

Nearly as many, 63%, feel challenged by issues of supply chain disruption, contingency planning, and risk management. Just behind that, 60% of respondents cite challenges related to investing in technology.

And, like the shippers they serve, most 3PLs worry about finding, training, and retaining qualified labor. Other challenges on the radar of more than one-third of 3PL respondents include capacity (cited by 49%), data management and digital transformation (41%), compliance and regulations (35%), and meeting customer service requirements (34%).

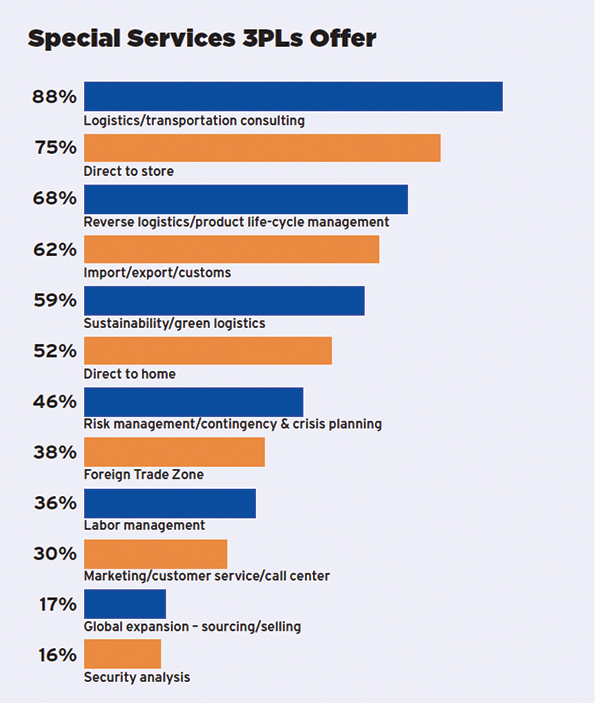

Along with typical services for planning and executing logistics processes, and along with technology solutions, many 3PLs also offer special services related to the supply chain. For example, most 3PLs in our survey can serve as consultants, helping shippers design and/or implement logistics and transportation strategies.

Three-quarters of respondents help customers deliver product directly to retail stores, rather than to retailers’ distribution centers. A large segment of respondents (68%) offer reverse logistics or product life-cycle management, and 62% help shippers with imports, exports, and customs clearance.

One special service that has grown in the past year is risk management and contingency and crisis planning. In 2019, 33% of 3PLs said they offered that service; in 2020, it’s 46%. Given the hazards that COVID-19 has presented to U.S. shippers, from factory closings in China to the shuttering of countless businesses at home, the need for such services will continue to grow.

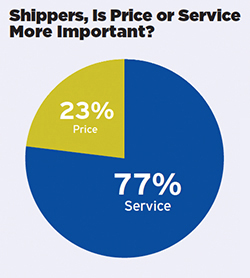

Shipper respondents clearly understand that you get what you pay for. More than three-quarters of shippers who responded to the survey—77%—tell us that service is more important than price in a relationship with a 3PL. When we asked shippers to name their top three 3PLs and explain their choices, phrases such as “excellent service,” “willingness to go the extra mile,” and “personal touch and innovation” figured prominently in the responses.

The value of excellent customer service comes through loud and clear when we asked shippers to define the top reason why a partnership with a 3PL might founder.

Service figures in 85% of responses, including 62% who name poor customer service outright, and 23% who note that a partnership can fall apart when a 3PL fails to meet expectations.

Only 20% name money as the top reason for failure, based either on the cost of using an incumbent 3PL or the fact that the shipper has discovered more competitive alternatives.

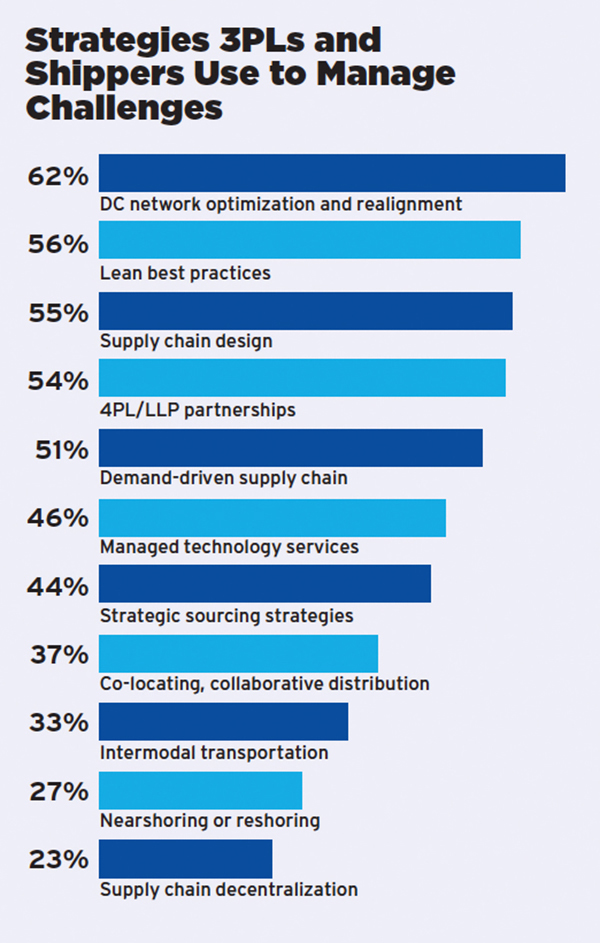

Most 3PLs focus on the way operations are organized when they work with shippers to address challenges. For example, 62% of 3PL respondents say they work on optimizing and realigning the DC network, while 55% use strategies that feature supply chain design.

Other strategies cited by more than half of respondents are lean best practices (56%) and demand-driven supply chain (51%). This addresses shippers’ most cited challenge: cutting transport costs.

Companies may also redesign their collaborative relationships: 54% work with a fourth-party logistics (4PL) provider or lead logistics provider (LLP) to coordinate their other partnerships.

As 3PLs work to attract customers, they can do more than woo shippers completely away from their current partnerships. Many shippers are open to working with more than one 3PL. Among our shipper respondents, only 23% say that a company should partner with just one 3PL. Thirty-five percent say it’s best to work with more than one, and 42% are open to the idea, saying that the answer depends on circumstances.

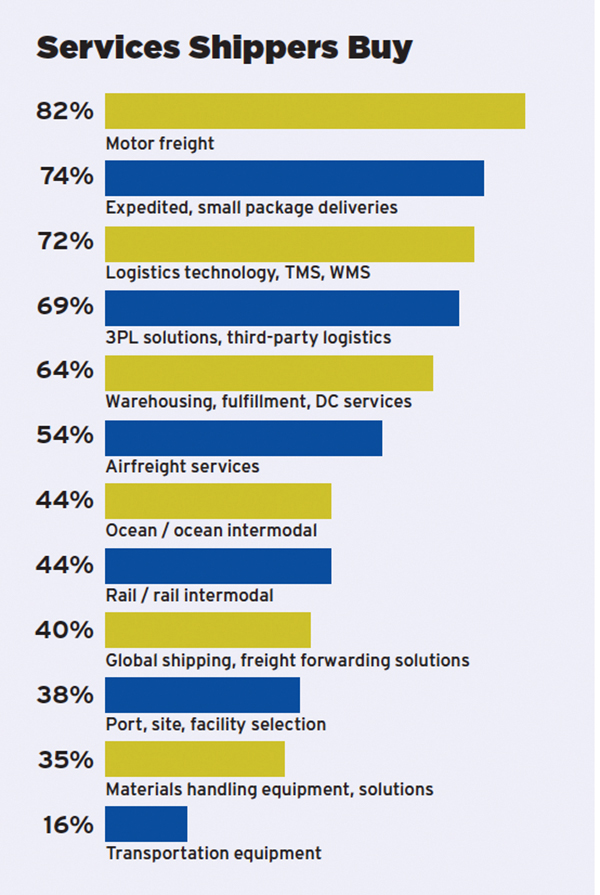

No matter what other services shippers obtain from their 3PLs, they likely rely on them for trucking capacity. Among shipper respondents, 82% say they buy motor freight services from 3PLs. And—not surprising in an era of soaring demand for e-commerce and fast deliveries—74% of them use 3PLs for expedited and small package delivery. Shippers also turn to 3PLs in healthy numbers for airfreight services (54%), ocean or ocean intermodal services (44%), and rail or rail intermodal services (44%).

3PLs also play a big role in storing inventory and getting it out the door; 64% of shippers say they buy warehousing, fulfillment, or distribution center services from 3PLs.

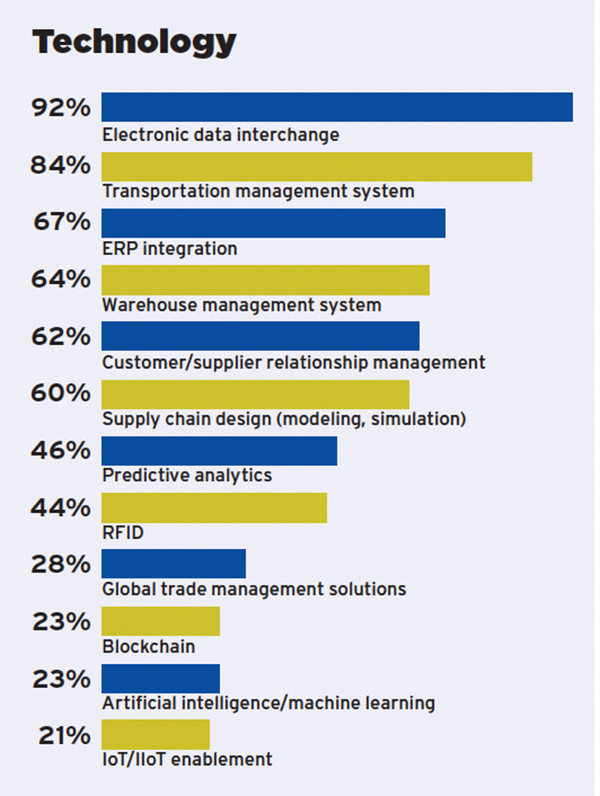

One non-traditional area where the profile of 3PLs is increasing is information technology. In 2020, 72% of shippers tell us they buy some kind of logistics technology from a 3PL, up from 56% in 2019.

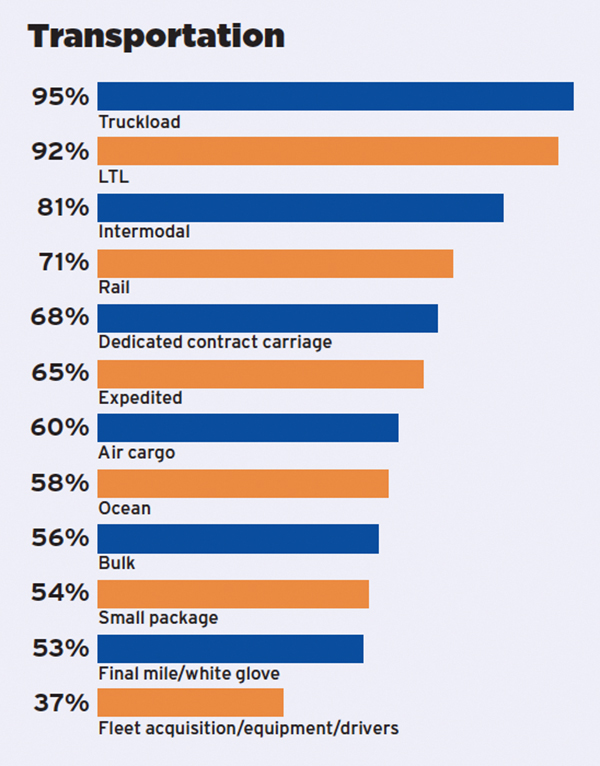

While covering a range of transportation modes (with truckload resoundingly topping the list), 3PL respondents also offer a variety of specialized transportation services.

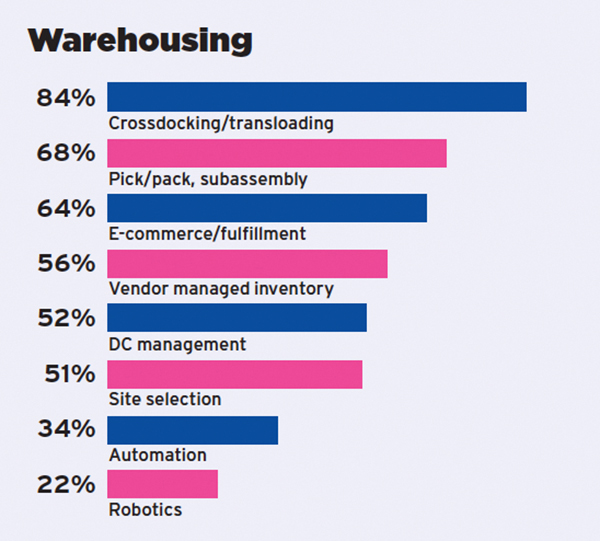

A shipper that needs a partner to handle crossdocking or transloading won’t have to search far: a healthy majority of 3PLs responding to the survey offer those services.

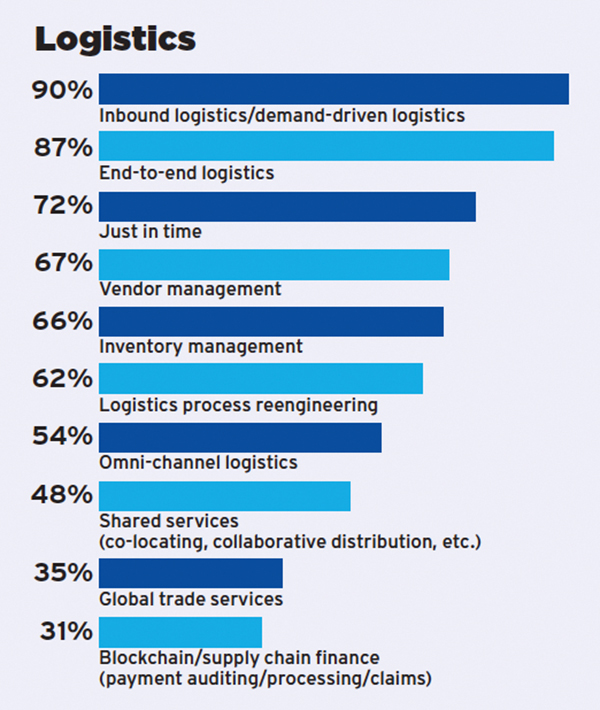

Nearly all the 3PLs in our survey, 90%, offer service for managing inbound or demand-driven logistics. Almost the same proportion, 87%, can manage the entire logistics process for shippers.

Most 3PLs offer software and other kinds of information technology support. More advanced technologies, such as blockchain and AI, are also starting to appear in 3PL portfolios.

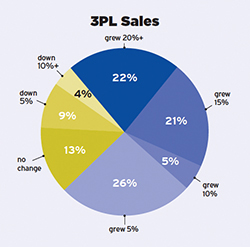

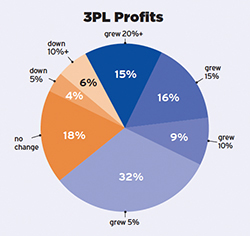

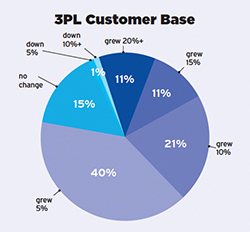

The past year has been good to 3PLs, although not as outstanding as 2018-2019. Among our 3PL respondents, 74% report that sales have increased year over year (compared with 95% in 2019); 72% say their profits have grown (compared with 92% in 2019); and 83% have increased their customer bases (not much lower than the 2019 figure, 89%).

The specific levels of the gains reported this year are more modest as well. For example, in 2019, more than half of 3PLs had seen sales grow by at least 15%, and a similar proportion had seen profits grow by that amount. In 2020, 43% of 3PLs have seen sales increase by 15% or more, and 31% have seen profits rise by at least 15%.

3PLs attribute their growth to excellent service, outstanding employees, sales and marketing efforts, and corporate acquisitions. The healthy proportion of 3PL respondents reporting continued growth underscores that enterprises tend to partner with entities that are financially healthy, growing, and making a profit. These figures indicate that 3PLs are meeting shippers’ needs and providing the solutions that address their most pressing concerns.

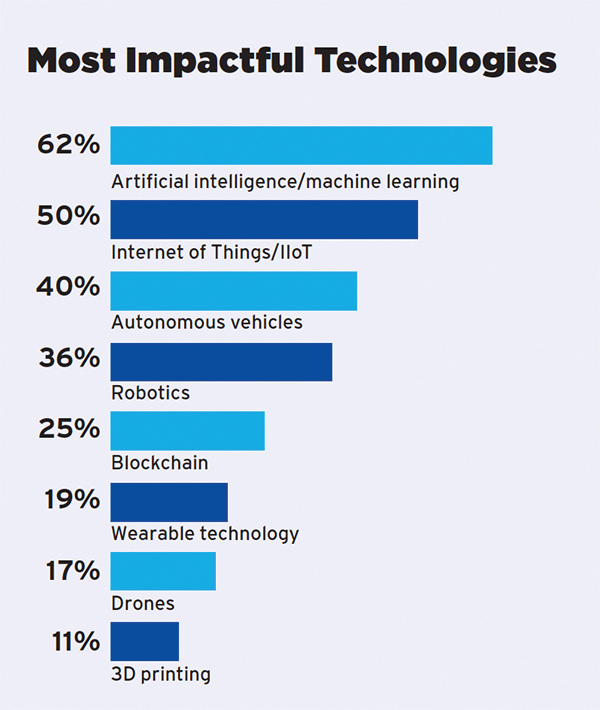

Some technologies that 3PLs are least likely to offer to their customers right now are the very technologies that 3PLs identify as most likely to make a profound impact on their industry. When asked which technologies they consider most disruptive, 62% name artificial intelligence and/or machine learning—the top choice by a long shot among respondents.

Half of the 3PL respondents point to the Internet of Things (IoT) or the Industrial Internet of Things (IIoT), 40% mention autonomous vehicles, and 36% cite robotics. Only a small proportion of 3PLs say they expect to see blockchain, wearable technology, drones, or 3D printing impact the way they or their customers do business.

About the 3PL Respondents

Asset-Based or Non-Asset-Based

- Both: 47%

- Non-Asset: 43%

- Asset: 10%

GEOGRAPHIC COVERAGE

- North America: 52%

- Global: 26%

- U.S. only: 21%

MARKETS SERVED

- Transport sector: 92%

- Manufacturing: 87%

- Retail: 83%

- Wholesale: 76%

- E-commerce: 72%

- Services: 54%

2019 REVENUE

Participants in this survey report in excess of $220 billion in sales in 2019. Several did not report revenue so the amount is likely higher.

How to Find a 3PL-Third Party Logistics Provider

Choosing third-party logistics companies or logistics providers that offer the best 3PL solutions and services can be difficult. Inbound Logistics can help.

This 3PL Request for Proposal (RFP)/Request for Information (RFI) service can help you find the 3PL and 4PL providers that can meet your specific 3PL service challenges and needs. The 3PL companies below will provide free, no-obligation third-party logistics advice, solutions, and information specific to your logistics management needs.

Ask your 3PL questions, you’ll get answers. Simply complete the information, and detail your 3 PL logistics challenges below. Then, check off the third-party logistics companies that you want to review your request.

Third Party Logistics Provider

"*" indicates required fields