3PL Perspectives 2016

Perspectives Methodology

3PLs At A Glance

2016 Top 100 3PLs

Ever get a tattoo? You don’t just go to the first place you stumble across. It usually takes some shopping around to find the right parlor. You ask your friends and acquaintances for recommendations. You go on the internet and read reviews. Eventually you narrow it down to the right artist, and you take the plunge. Maybe it’s scary. Maybe you worry that as you change and grow, the tattoo won’t be a good fit for you anymore. Doesn’t sound so different from finding a logistics partner.

Your tattooist and third-party logistics (3PL) provider are both artists in their respective fields. Making a deal with either can be a big commitment. Both the ink master and the logistics master will do their best to calm your fears before they begin working. And if the situation calls for you to drop your guard and bare some secrets, they’ll keep it between the two of you.

It has been an interesting year for logistics and the supply chain (and probably for tattoo artists, too). The United States continues to recover from the 2008 recession. The trucking capacity crisis finally broke, though the driver shortage continues in select lanes and many experts predict another capacity crunch looms for 2017. American transportation infrastructure continues to crumble as it remains chronically underfunded. It’s an election year, and the Trans-Pacific Trade Partnership hangs in the balance.

Across the pond, the population of the United Kingdom voted to leave the European Union, which sent markets plummeting and has the potential to turn the European supply chain upside down. Across the other pond, China seems headed for a recession, which will impact the entire Asian region and the world. In many regions, a growing consumer class is spurring opportunities for growth. Companies will need new skills, technology, and know-how to leverage this consumption uptick.

All this uncertainty and opportunity leads many companies to seek 3PLs with the expertise to help navigate uncertain or uncharted waters. During and after the Great Recession, shippers and manufacturers used 3PLs to improve supply chain visibility, streamline processes, reduce costs, drive growth, and, in some cases, survive. With so much up in the air for global supply chains, these 3PL relationships will only keep expanding.

Growth Slows Year-Over-Year

Growth in the 3PL sector has fallen for the second year in a row, and a bit further this year than last. In 2015, 91 percent of 3PLs responding to Inbound Logistics‘ 3PL Perspectives market research survey added 5 percent or more new customers. In 2014, the growth was 92 percent. For several years prior, growth had been strong and steady, going all the way back to 2011, where survey respondents reported only 73 percent growth. But in 2016, only 84 percent of respondents report growth.

This slip in sector growth is likely due, in part, to economic stabilization. As companies finally begin to pull out of panic mode, they are leaning less on logistics providers to shield them from supply chain interruption and market fluctuations. And many 3PLs count on shipment volumes as a source of revenue. With growth stalled in many industries, shipments are down, and some 3PL earnings reflect that.

Still, with uncertainties overseas both East and West, 3PLs might soon find themselves with plenty of new clients struggling to adapt their logistics practices to changing trade agreements and consumer growth.

Also, 12 percent of 3PLs surveyed report a decline in business. When the supply chain is streamlined and logistics operations run smoothly, it’s important to remember how they got that way. Organizations sometimes try to save a buck by cutting their partners loose when things look good, but that might not be the most forward-thinking business decision. Companies often break ties with partners only to find they don’t have the infrastructure to maintain what the provider built. Think about the technology solutions your 3PL provides, such as performance evaluations, shipment tracking, business intelligence, and visibility. Many shippers aren’t equipped to take on those tasks on their own. Even when the supply chain is finely oiled, the logistics provider’s value doesn’t diminish. Success plays a role, too. As customers optimize logistics and supply chains, and overcome logistics challenges, 3PLs are left with less to do.

The good news is that the moderate decline in customer growth doesn’t seem to have greatly affected profits. This year’s survey reveals that 87 percent of respondents increased profits by at least 5 percent. This falls in the middle of recent years, compared with 90-percent revenue growth in 2015, and 82 percent in 2014. In fact, more than 25 percent of those surveyed report revenue increases of more than 20 percent. What’s behind this growth?

First, technology and efficiency upgrades that providers implemented during the recession are now improving the bottom line post-recovery, when more money is coming in. Second, the oil market’s continued oversaturation drove prices to lows most of us never expected to see again. That’s not great news for 3PLs specifically tied to the oil and gas industry, which likely contributed to the 3-percent decline compared to 2015. But for most companies providing transportation services, low oil prices are good for the corporate wallet.

Despite the downward motion of customers and profits, most companies pushed harder on sales initiatives. More than 85 percent of 3PLs surveyed say sales were up by at least 5 percent. One 3PL attributes its increased sales to air services it provided to shippers affected by the West Coast port strike. “Growth in sales and customers is a combination of organic growth through winning new customers and providing additional services to existing customers,” says another provider.

Holding these sales and profit numbers fairly steady is the 3PL’s ability to diversify its customer base. No matter which industry is being served, logistics practices have some overlap. As such, most providers can specialize in many verticals, and help implement supply chain practices for just about any shipper that needs them.

By serving multiple verticals, 3PLs insulate themselves from too much impact if one winds up in the red. For example, one logistics provider says: “Our transportation business was flat due mainly to decline in the oil and gas industry. Our value-added services business was up due to an enhanced sales effort and increasing customer demand for our services.”

Manufacturing (89 percent); transportation (87 percent), which includes warehouses, carriers, and other 3PLs; and retail (86 percent) remain the top markets served by logistics providers. Specialized verticals also continue to be profitable. Consumer packaged goods (83 percent) and food and beverage (81 percent) top the list of verticals providers serve, while automotive, electronics, and construction and building materials tie for third at 73 percent each.

“Our dedicated sales team strives to identify new opportunities and expand into new verticals so we can offer our services to an increasingly diverse customer base,” says one respondent. “By developing new vertical markets, we are further strengthening the foundations of our organization against external shifts in economy or industry.” Past downturns taught 3PLs that overspecialization can lead to having too many eggs in one basket.

Some of 2015’s vertical specialization upticks moved in the opposite direction in 2016. Fewer providers (61 percent) report serving healthcare. Furniture dropped from 66 to 64 percent, and renewable energy from 43 to 38 percent. Large increases in servicing these areas last year likely tapered off as some providers found their niche in a specific vertical, while others found it wasn’t for them.

While you might expect 3PLs to move away from the oil sector as a result of recent price trends, the oil and gas sector actually gained 1 percent, moving from 44 percent in 2015 to 45 percent in 2016. Some attribute the growth to an increase in the use of natural gas and other cleaner products as pollution-conscious countries continue to slowly phase out coal.

Get Your Assets in Gear

A plethora of non-asset-based brokers entering the market shook up the 3PL sector in recent years. Asset-based carriers were hit by the recession and struggled to lean assets while trying to compete with non-asset brokers.

With the recession coming to a close, asset-based 3PLs have been able to ease up on cost-cutting measures. As such, providers were less afraid to acquire property, and there was an increase in providers that consider themselves asset-based in 2016 (14 percent), compared to 11 percent in 2015. One 3PL reports owning more than 700 warehouses, and three say they own more than 100,000 trucks each. This balances a slight decline in non-asset-based providers, with 44 percent declaring themselves non-asset-based, as opposed to 46 percent in 2015. In addition, 42 percent say they are both asset- and non-asset-based.

Even though the capacity crisis that plagued the freight industry eased up some in 2016, it won’t be held at bay forever. The driver shortage is expected to continue growing, and new regulations such as the Driver Coercion Law will come into play. Both will inevitably affect freight capacity.

For now, shippers are doing their best to push rates down in advance of the next crunch. But moving forward, asset-based providers likely won’t struggle finding new shippers and intermediaries looking to secure available capacity before it’s already filled.

Shippers Have Problems, 3PLs Have Technology

With only 52 percent of 3PL respondents listing capacity as a problem (versus 65 percent in 2015), new issues top the list of big concerns. Technology investments are the biggest worry, with 62 percent of respondents naming it as a top challenge. 3PLs have to keep up on the latest IT investments, because their clients sometimes don’t. “Shippers are in the Dark Ages, technology-wise, compared with brokers and carriers,” says one respondent. Less than half (48 percent) of shippers list supply chain technology as something that they buy themselves.

Many shippers and manufacturers hire 3PLs specifically to tap into technologies that the shipper doesn’t have. As cloud networks and the Internet of Things connect each step in the supply chain, it becomes easier for providers to host and lend Software-as-a-Service technology to their clients. This saves the shipper from a large technology investment and helps the 3PL maintain value and service. Many 3PLs also have a good record of helping shippers eventually integrate their own technologies.

After technology, 54 percent of providers list finding, training, and retaining labor as their next biggest problem, and 22 percent of shippers have the same concern. In 2015, 57 percent of providers and 14 percent of shippers listed the issue as a problem.

With a marginal decrease in labor concerns for providers, and an 8-percent increase for shippers, the cost of government regulation and related issues means shippers will continue to outsource transportation, logistics, and supply chain functions so they don’t have to invest in finding and training their own labor. It’s no secret that there’s a shortage of skilled labor in the logistics, transportation, and manufacturing sectors. This trend circles back to technology, as 3PLs are often already making the appropriate technology and automation investments to offset labor concerns.

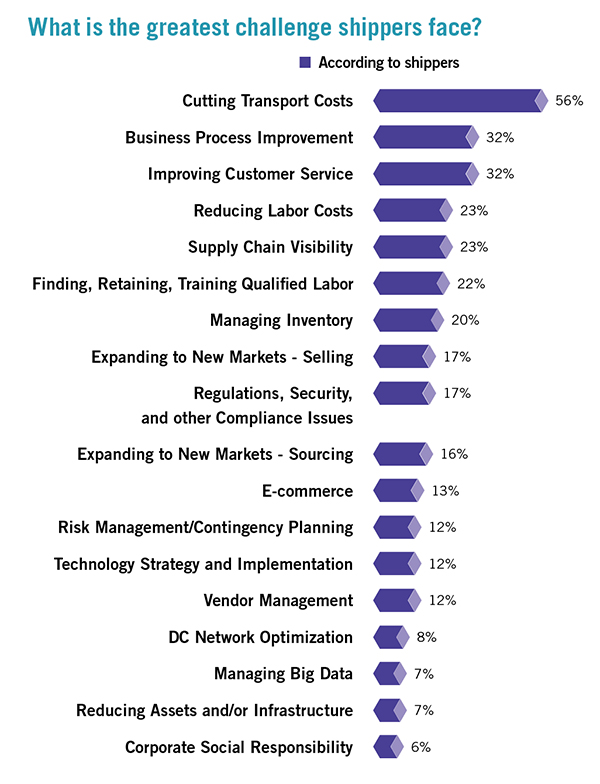

Among shippers, 56 percent of respondents rate cutting transport costs as their biggest challenge, followed distantly by business process improvement (32 percent), and improving customer service (32 percent). These are all challenges that can be met with technologies and expertise that many 3PLs already have or can readily obtain more easily than most shippers.

Here’s something that will allay any doubt you might have about how much shippers rely on 3PLs for IT services: When asked why their particular 3PL deserves industry recognition, hundreds of shippers commented that their 3PL had “best-in-class technology.”

What Shippers Want

Technology isn’t always the primary factor when companies decide to outsource. Motor freight (75 percent), warehousing and distribution (66 percent), and small package/expedited/express (65 percent) were the top three services shippers say they purchase. 3PL services came in a close fourth at 64 percent, though, of course, they overlap with the top three in many cases.

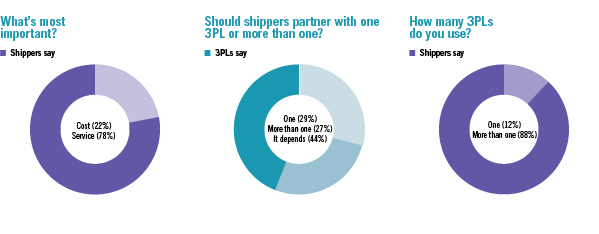

Many 3PLs got their start in transportation management, so naturally services such as trucking, warehousing, and package delivery will always be a part of the industry. But during the recession, shippers had a lot more say over how much they paid for these services. With less control over cost, shipper demands are now changing. When asked to choose between the importance of cost or customer service, 78 percent prioritize customer service—an 8-percent rise from 2015.

Cost and customer service often go hand in hand. One shipper sings the praises of a 3PL who refunded the entire cost of a shipment after delivering late. Many others equate great rates with great service. Preferring service over cost doesn’t mean shippers don’t want low rates, it just means they want to pay the lowest rate possible without sacrificing service. One shipper hits the nail on the head about the value of customer service: “My 3PL recognizes that our success is their success as well.”

The service that consumers have come to expect from retailers reverberates back up the supply chain. When shoppers want products fast, retailers need their shipments fast. Manufacturers need their supplies fast. Suppliers need their raw materials fast. Everything speeds up, all the way down the chain. A large part of customer service is reliability, and with the new pace and expectations set by the e-commerce age, reliability is one of the most valuable things that a 3PL can provide.

Shippers list bad customer service (39 percent) and failed expectations (32 percent) as the top reasons why 3PL relationships fail. Cost, however, comes in as an afterthought at a distant 6 percent (down from 15 percent in 2015), just after competition at 8 percent (down from 14 percent in 2015). The downward trends of cost and competition show that 3PLs are doing a good job of remaining competitive and providing good service at a good price point.

However, 40 percent of 3PL respondents still say that finding and retaining clients is a challenge. As demand for customer service continues to rise, logistics providers will need to meet that demand if they want to hang on to their customers. After all, it’s a lot easier to please an existing customer than it is to find a new one.

Even with the industry’s high customer service levels, some shippers still want to diversify: 29 percent of respondents use more than one 3PL, while 26 percent use only one. The biggest percentage, 44 percent, say the number of 3PLs required depends on the given situation, such as vertical, function, or location. If a shipper picks up a second 3PL because it offers a service or location their existing partner can’t provide, that doesn’t necessarily reflect on the existing partnership. It’s just good business.

Around the World

3PLs have come a long way from the days of helping companies source cheap suppliers in far-flung global locations. Today, many areas that once were known for cheap manufacturing services have built their own consumer culture. The rising consumer class in China is a good example of this phenomenon. And it’s not just the giants playing overseas anymore. Thanks to the internet and the age of e-commerce, even little guys can push product overseas, creating a growth area for many 3PLs.

This can make things confusing for global operators. Should you nearshore your operation close to home, or move it near your next big market to feed expected demand? It’s not always feasible to have manufacturing facilities or storage space in every market served, and this is definitely one area where the right logistics provider can make all the difference. Many of the project requests that IL received this past year reflect that trend.

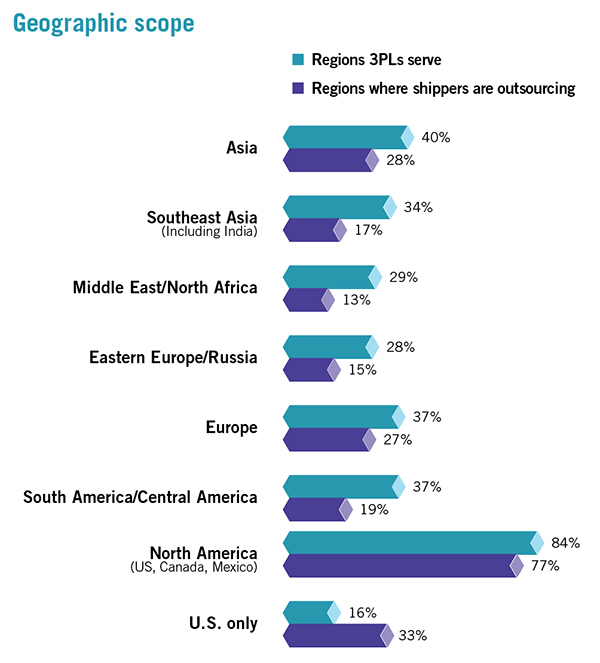

Among respondents, 40 percent of 3PLs offer services in Asia, and 34 percent in Southeast Asia. Meanwhile, 28 percent of shippers contract with a 3PL in Asia, and 17 percent use logistics providers in Southeast Asia. Compared with 2015 data, shippers are outsourcing 6 percent more in Asia, but 3 percent less in Southeast Asia. As China gets nearer to a recession, demand in the region may be reduced until the country’s new middle class can stabilize.

There has also been an increase in Europe, with 27 percent of shippers outsourcing there, up from 20 percent in 2015; 37 percent of providers surveyed say they offer coverage in Europe. This number will likely climb steadily on both sides as the European supply chain reshapes itself and trade between the United Kingdom and the European Union gets more complicated.

Also of note, 19 percent of shippers contract logistics services in South/Central America, up from 15 percent in 2015, and 37 percent of providers offer coverage in the region, down from 43 percent. With the expanded Panama Canal newly opened, there’s likely to be a surge of logistics activity in this region moving forward. 3PLs will no doubt be there to pick up the slack.

Perspectives Methodology

Every year, Inbound Logistics conducts an extensive survey of the 3PL market to explore how both logistics service providers and shippers are adapting to change, and pushing the outsourcing needle in new directions.

Our outreach effort comprises two parts. First, IL solicited questionnaires from nearly 300 3PLs detailing the services they provide and their areas of expertise—geographically, functionally, and vertically. We also asked service providers to supplement this empirical data with contextual insight about business during the past year, relationships with customers, and emerging outsourcing trends.

Secondly, we received input from 6,600 3PL users to provide a counter perspective of the different considerations shaping outsourcing decisions.

Inbound Logistics’ 3PL Perspectives juxtaposes these two points of view to provide a robust overview of the trends that are impacting the 3PL space, and how shippers and service providers are responding.

3PLs At A Glance

| ASSET-BASED OR NON-ASSET BASED | |

| Non-asset-based | 44% |

| Asset-based | 14% |

| Both | 42% |

| VERTICAL SPECIALIZATION | |

| Consumer Packaged Goods (CPG) | 83% |

| Food & Beverage | 81% |

| Automotive | 73% |

| Construction & Building Materials | 73% |

| Electronics | 73% |

| Apparel & Textiles | 65% |

| Furniture | 64% |

| Grocery | 64% |

| Healthcare | 62%> |

| Chemicals | 59% |

| Agriculture | 57% |

| Pharmaceuticals | 52% |

| Oil & Gas | 46% |

| Aerospace | 41% |

| Renewable Energy (Wind & Solar) | 38% |

| Trade Show | 38% |

| No Particular Specialty | 1% |

| CERTIFICATIONS | |

| SmartWay | 61% |

| C-TPAT | 48% |

| ISO | 35% |

| Lean | 24% |

| Six Sigma | 20% |

| AIB | 23% |

| Responsible Care | 9% |

| ICCA | 8% |

| LOGISTICS SERVICES & CAPABILITIES | |

| Inbound Logistics | 89% |

| Integrated Logistics | 81% |

| Inventory Management | 69% |

| JIT | 68% |

| Lead Logistics Provider/4th-Party Logistics | 63% |

| Vendor Management | 63% |

| Shared Services (co-locating, collaborative distribution) | 59% |

| Logistics Process Reengineering | 56% |

| Payment Auditing/Processing | 46% |

| Global Trade Services | 39% |

| TRANSPORTATION SERVICES & CAPABILITIES | |

| Truckload | 95% |

| LTL | 91% |

| Intermodal | 84% |

| Rail | 70% |

| Dedicated Contract Carriage | 65% |

| Ocean | 59% |

| Air Cargo | 58% |

| Final Mile | 50% |

| Small Package | 49% |

| Bulk | 48% |

| Equipment/Drivers | 38% |

| Fleet Acquisition | 20% |

| None | 1% |

| SPECIAL SERVICES | |

| Logistics/Transportation Consulting | 87% |

| Direct to Store | 71% |

| Reverse Logistics/Product Lifecycle Management | 65% |

| Import/Export/Customs | 59% |

| Sustainability/Green Logistics | 59% |

| Direct to Home | 46% |

| Foreign Trade Zone | 41% |

| Contingency/Crisis Planning | 34% |

| Labor Management | 34% |

| Global Expansion (Sourcing and Selling) | 23% |

| Security Analysis | 18% |

| None | 47% |

| TECHNOLOGY/WEB SERVICES & CAPABILITIES | |

| EDI | 96% |

| TMS | 89% |

| Visibility | 80% |

| Optimization | 71% |

| Customer Relationship Management/Supplier Relationship Management | 64% |

| WMS | 62% |

| Freight Payment/Claims/Auditing | 59% |

| Wireless/RFID | 56% |

| Supply Chain Design (modeling, simulation) | 53% |

| ERP | 49% |

| Sustainability | 45% |

| Predictive Analytics | 37% |

| Global Trade Management | 30% |

| None | 1% |

| INDUSTRIES SERVED | |

| Manufacturing | 89% |

| Transportation (includes 3PLs, warehousing, carriers, international trade) | 87% |

| Retail | 86% |

| Wholesale | 78% |

| e-Business | 61% |

| Services/Government | 50% |

| WAREHOUSING SERVICES & CAPABILITIES | |

| Crossdocking | 80% |

| Transloading | 67% |

| Pick/Pack, Subassembly | 66% |

| Fulfillment | 65% |

| Vendor Managed Inventory | 59% |

| DC Management | 55% |

| Site Selection | 46% |

| None | 13% |

2016 Top 100 3PLs

Inbound Logistics’ 21st annual Top 100 3PL list, as selected by IL editors, complements 3PL Perspectives. This annual compendium celebrates logistics service providers that are at the top of their game while detailing the broad array of services and solutions these companies provide.

Pulling together this list of Top 100 3PLs demands a great deal of due diligence. Nearly 300 companies submitted questionnaires for consideration this year, and IL editors conducted a careful analysis of surveys, phone interviews, and online research to qualify and vet these selections.