2024 Trucking Perspectives

In its annual market report, Inbound Logistics looks at the road ahead for the trucking sector, and explores the issues of greatest concern to carriers and shippers.

Motor carriers are feeling squeezed these days. The market for transportation has been soft, pushing freight rates downward. And to cap it off, pundits and trucking industry experts aren’t sure when that situation will change.

But even as trucking firms have been forced to charge their customers less per mile, they need more income to maintain their operations. Over the past year, truckers have been paying more for many essentials, such as equipment, insurance, interest on loans, and, at least until recently, fuel.

Shippers also worry about expenses. The rates they pay to put freight on the road might be lower than in the early phase of the post-COVID era, but shippers still cite transportation costs as a major challenge. Many also name price as one of the most important things they consider when choosing a trucking company, making that factor slightly more crucial to the partnership than reliability or capacity.

These are just a few of the insights you’ll find in Inbound Logistics’ 2024 Trucking Perspectives report. Each year, we ask both truckers and shippers to tell us what impact current conditions are having on their businesses, and how they are responding. In the following pages, you’ll see how things stand with the industry in 2024.

TRUCKERS: As a leading economic indicator, where do you see the economy trending?

When it comes to the economy, there are fewer all-out optimists among trucking company executives in 2024 than there were one year ago. Today, only 16% of trucking company respondents see the economy trending upward, compared with 22% last year. At the same time, there are also fewer genuine pessimists. Only 6% of truckers say the economy is trending downward, compared with 12% in 2023.

When it comes to the economy, there are fewer all-out optimists among trucking company executives in 2024 than there were one year ago. Today, only 16% of trucking company respondents see the economy trending upward, compared with 22% last year. At the same time, there are also fewer genuine pessimists. Only 6% of truckers say the economy is trending downward, compared with 12% in 2023.

For most motor carriers, this is a wait-and-see period, not surprising in the midst of a tight presidential election. Last year, 66% of truckers saw the economy hovering somewhere in-between up and down. This year, that proportion has risen to 79%.

TRUCKERS: What are your greatest challenges?

With less demand for freight capacity in the past year, shippers have gained the power to shop around for the trucks they need at rates they’re willing to pay. That’s forced many trucking companies to compete on price. In 2023, only 37% of our trucking respondents noted price pressure from customers and/or competitors as one of their greatest challenges. In 2024, that number has jumped to 53%. That makes price pressure the second-biggest concern this year, after insurance costs and liabilities.

With less demand for freight capacity in the past year, shippers have gained the power to shop around for the trucks they need at rates they’re willing to pay. That’s forced many trucking companies to compete on price. In 2023, only 37% of our trucking respondents noted price pressure from customers and/or competitors as one of their greatest challenges. In 2024, that number has jumped to 53%. That makes price pressure the second-biggest concern this year, after insurance costs and liabilities.

The survey also shows a big jump in concern about cargo theft and load security. This year, 26% of trucking respondents mention that as a major challenge, compared with just 7% in 2023. That stands to reason, considering the crime wave the transportation industry has suffered in the past year. For instance, in July, researchers at CargoNet reported 771 incidents of cargo thefts in the second quarter of 2024—33% more than in the second quarter of 2023. In a growing number of cases, sophisticated fraudsters steal the identities of legitimate truckers, pick up loads from shippers, and then disappear with the goods.

As they worry about rates and security, trucking companies are breathing easier about some other aspects of their operations. In 2023, driver-related costs stood at the top of the list of major challenges for truckers: 66% cited those as a concern. In 2024, we rephrased the question slightly, asking about all driver-related challenges, such as recruitment, retention, and training. Forty-seven percent of truckers name this cluster of challenges as a significant concern. This is smaller than the proportion of truckers—54%—who are concerned about insurance costs and liabilities, the top challenge listed this year.

Trucking executives also are less worried about fuel costs: 29% name those as an important challenge, compared with 51% in 2023. Fuel prices have fallen slightly during the summer of 2024. Beyond that, perhaps truckers have simply grown resigned to the prices they currently pay at the pump and feel that, having built those costs into their freight rates, they have resolved the challenge for now.

SHIPPERS: What are your greatest challenges?

Although a freight recession in the past year has pushed down transportation rates, transportation costs still emerge as the top challenge for shippers, cited by 66% of shipper respondents. Of course, total transportation costs depend on other factors beside rates, such as how far companies ship their goods and how much complexity they’ve built into their supply chains.

Although a freight recession in the past year has pushed down transportation rates, transportation costs still emerge as the top challenge for shippers, cited by 66% of shipper respondents. Of course, total transportation costs depend on other factors beside rates, such as how far companies ship their goods and how much complexity they’ve built into their supply chains.

Like the truckers who serve them, shippers see cargo theft and security as a much bigger challenge this year than in 2023. Forty-one percent of shippers cite this as a major concern this year, compared with only 12% last year. Also, more shippers this year see customer service as a significant challenge—50% compared with 37% in 2023.

While truckers as a group feel more pressure this year to reduce prices, shippers as a group are feeling slightly less pressure from their own customers and competitors to drop theirs. Shippers are also just a tiny bit less concerned about finding capacity this year than in 2023.

Twenty-three percent of shippers say they face challenges with environmental, regulatory, and security compliance. While that’s not even one-quarter of the shippers who responded to the survey, it’s more than double the 11% who named regulatory compliance as a major concern in 2023.

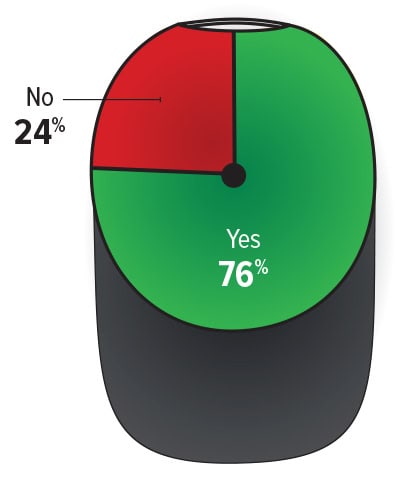

TRUCKERS: Do you have a freight brokerage or logistics services division/subsidiary?

Just over three-quarters of the trucking companies represented in our survey have created divisions that specialize in freight brokerage or logistics services. That’s a substantial number, but it’s smaller than the 87% who indicated in 2023 that they had formed business units to provide those services.

Just over three-quarters of the trucking companies represented in our survey have created divisions that specialize in freight brokerage or logistics services. That’s a substantial number, but it’s smaller than the 87% who indicated in 2023 that they had formed business units to provide those services.

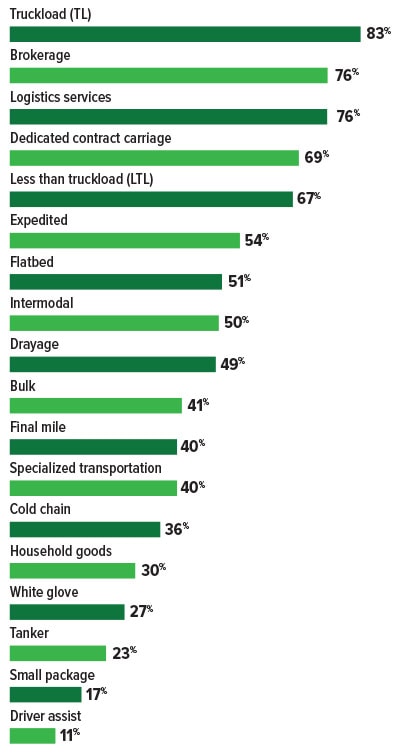

TRUCKERS: What types of services/solutions do you offer?

Full truckload (TL) transportation is the easiest motor carrier service to find among our trucking respondents; 83% of them offer that service. A smaller number—67%—provide less-than-truckload (LTL) service, while just 17% carry small packages. If you want to take advantage of capacity beyond what’s available in a carrier’s own fleet, 76% of respondents provide brokerage services. An equal proportion offer a range of logistics services in addition to over-the-road transportation.

Full truckload (TL) transportation is the easiest motor carrier service to find among our trucking respondents; 83% of them offer that service. A smaller number—67%—provide less-than-truckload (LTL) service, while just 17% carry small packages. If you want to take advantage of capacity beyond what’s available in a carrier’s own fleet, 76% of respondents provide brokerage services. An equal proportion offer a range of logistics services in addition to over-the-road transportation.

Half of our respondents handle intermodal transportation, and nearly the same number—49%—provide drayage services.

While 40% of truckers in our survey say they provide specialized transportation, a larger number offer specific kinds of specialized services, including expedited (54%), flatbed (51%), and bulk (41%). Just 36% of respondents provide cold chain transportation.

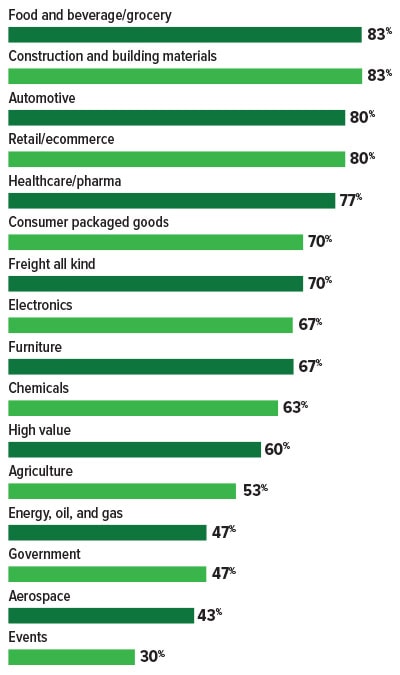

TRUCKERS: What industries/commodities do you serve?

Year after year, food/beverages and other grocery items make up the most popular market for truckers. In 2024, 83% of respondents say they carry those commodities, just slightly down from last year’s 87%. Several other top commodities or industries have grown a bit in importance since last year, including construction and building materials (83% vs. 78% in 2023), automotive (80% vs. 78% in 2023), and retail/ecommerce (80% vs. 73% in 2023).

Year after year, food/beverages and other grocery items make up the most popular market for truckers. In 2024, 83% of respondents say they carry those commodities, just slightly down from last year’s 87%. Several other top commodities or industries have grown a bit in importance since last year, including construction and building materials (83% vs. 78% in 2023), automotive (80% vs. 78% in 2023), and retail/ecommerce (80% vs. 73% in 2023).

Last year, 73% of respondents said they served high-value industries such as healthcare, pharmaceuticals, and others. In 2024, we divided that category into more precise components. We now find that 77% of respondents serve the healthcare or pharmaceutical industry, 67% serve the electronics industry, and 60% carry high-value cargoes of various kinds.

Other popular markets include consumer packaged goods (70%), freight of all kinds (70%), furniture (67%), and chemicals (63%).

TRUCKERS: What is your operating area?

In 2023, 61% of truckers told us they operated only in North America, while 39% covered just the United States. This year, we added a new option to our coverage question. With that in the mix, we learned that 58% of respondents provide service across North America, 36% operate just in the United States, and 6% provide global coverage.

In 2023, 61% of truckers told us they operated only in North America, while 39% covered just the United States. This year, we added a new option to our coverage question. With that in the mix, we learned that 58% of respondents provide service across North America, 36% operate just in the United States, and 6% provide global coverage.

TRUCKERS: What certifications do you hold?

A large majority of motor carriers continue to work with the Environmental Protection Agency’s (EPA) SmartWay certification program to make their operations more efficient and reduce their carbon emissions. In 2024, 84% of respondents hold SmartWay certification—slightly fewer than last year’s 88%, but still a significant proportion.

A large majority of motor carriers continue to work with the Environmental Protection Agency’s (EPA) SmartWay certification program to make their operations more efficient and reduce their carbon emissions. In 2024, 84% of respondents hold SmartWay certification—slightly fewer than last year’s 88%, but still a significant proportion.

The second-most popular certification for motor carriers remains the one that permits them to haul hazardous materials. Sixty-four percent of respondents hold HazMat certification, the same proportion as in 2023.

With 64% of carriers in the survey offering services outside the United States—across North America and/or elsewhere in the world—it stands to reason that many of them would sign on for programs that speed up the movement of cargo across international borders. This year, 53% of truckers tell us they participate in the Customs Trade Partnership Against Terrorism (C-TPAT) program, up significantly from last year’s 40%. Truckers are only about half as likely to earn two other border-crossing certifications, one from the Free and Secure Trade (FAST) program in the United States (27%) and Canada’s Partners In Protection (PIP) program (24%).

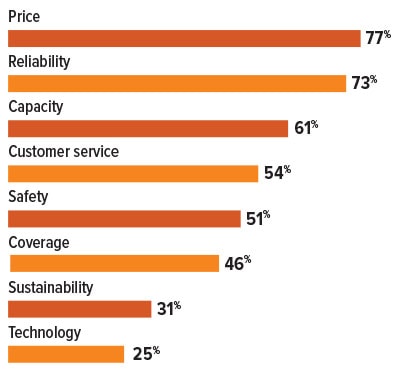

SHIPPERS: What are the most important factors to consider when choosing a motor carrier?

Like last year, our 2024 survey found that price and reliability are the most important factors that shippers consider when they choose a motor carrier. But the number of shipping executives who name those as top concerns has fallen a bit. This year, 77% of shippers cite price as an important factor, vs. 87% in 2023. Seventy-three percent mention reliability this year, compared with 88% last year.

Like last year, our 2024 survey found that price and reliability are the most important factors that shippers consider when they choose a motor carrier. But the number of shipping executives who name those as top concerns has fallen a bit. This year, 77% of shippers cite price as an important factor, vs. 87% in 2023. Seventy-three percent mention reliability this year, compared with 88% last year.

One concern that has increased markedly is capacity. The trucking industry has seen a freight recession in recent history, making space on trucks easier to find. But perhaps shippers are eyeing a future when inflation will ease, consumers will start spending more freely, and a fresh burst of commercial activity will fuel demand for over-the-road transportation. Whatever the reason, 61% of shippers say that capacity is an important factor when choosing a motor carrier, compared with only 47% a year ago.

More than half of our shipper respondents consider customer service and/or safety when choosing a trucking company. Sustainability is gaining some traction: 31% of shippers call that an important factor this year, vs. 20% in 2023. In addition, this year, for the first time, we asked shippers if a motor carrier’s technology plays a role when they choose a transportation partner. One-quarter of shippers told us that this is an important factor.

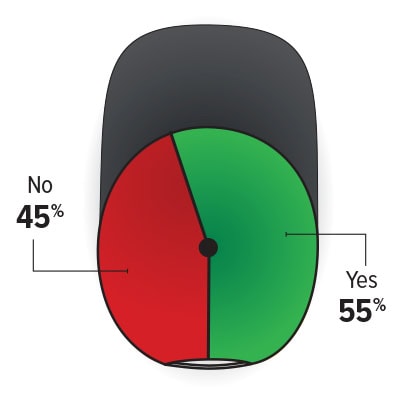

SHIPPERS: Have you experienced a shortage of truck capacity?

Pundits may report a soft market for over-the-road freight, but it seems that many shippers still can’t always find the services they need. This year, 55% of shippers say they have experienced a shortage of truck capacity, up from the 47% who reported that problem last year.

Pundits may report a soft market for over-the-road freight, but it seems that many shippers still can’t always find the services they need. This year, 55% of shippers say they have experienced a shortage of truck capacity, up from the 47% who reported that problem last year.

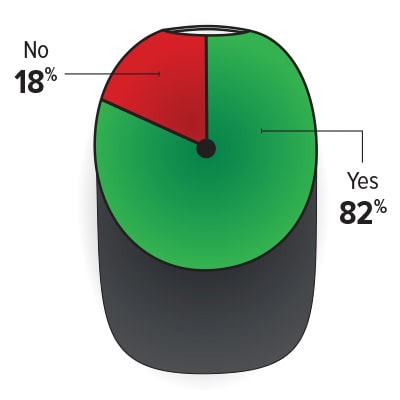

SHIPPERS: Have you experienced rate hikes apart from fuel surcharges?

Given the tight link between capacity and freight rates, it stands to reason that the number of shippers who have seen rate hikes would be tied to the number who have suffered capacity shortages. In 2024, 82% of shippers say they have experienced rate hikes apart from fuel surcharges, up from 74% in 2023.

Given the tight link between capacity and freight rates, it stands to reason that the number of shippers who have seen rate hikes would be tied to the number who have suffered capacity shortages. In 2024, 82% of shippers say they have experienced rate hikes apart from fuel surcharges, up from 74% in 2023.

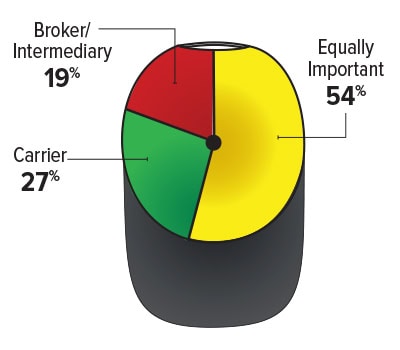

SHIPPERS: Which is more important—your relationship with your carrier or with your broker/intermediary?

Slightly more than half of shippers consider their relationships with their trucking companies and their brokers or other intermediaries equally important. Among the rest, truckers win the crown. Twenty-seven percent of shippers say their relationship with their carrier is more important than with a third-party partner; 19% say the opposite.

Slightly more than half of shippers consider their relationships with their trucking companies and their brokers or other intermediaries equally important. Among the rest, truckers win the crown. Twenty-seven percent of shippers say their relationship with their carrier is more important than with a third-party partner; 19% say the opposite.

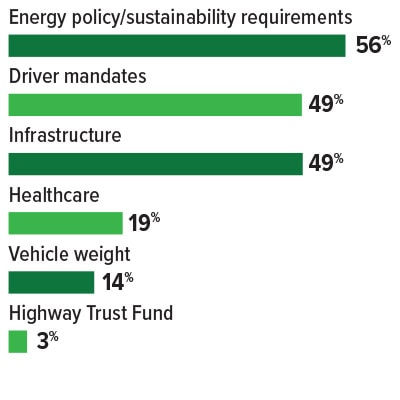

TRUCKERS: What legislative measures have the greatest impact on your business?

In recent years, legislation related to infrastructure has emerged as the government activity with the greatest impact on trucking companies.

In recent years, legislation related to infrastructure has emerged as the government activity with the greatest impact on trucking companies.

Last year, 79% of trucking respondents named legislation focused on roads, bridges, and other facilities as one of their big policy concerns. This year, that’s changed. Only 49% cite infrastructure legislation, while 56% say energy policy and sustainability requirements make a major impact on their business. That impact, of course, could come in a variety of areas, including fuel prices, the kinds of trucks motor carriers need to buy, and what it costs to operate and maintain those vehicles.

Another important category of government action is one that we included in this question for the first time this year—driver mandates. These include requirements such as Hours of Service regulations, testing requirements, and electronic logging devices (ELDs) to record driver activity. Nearly one-half of trucking respondents say that these mandates have a significant impact on their business.

Fewer truckers are concerned this year than last about healthcare legislation (19% vs. 21%) and the Highway Trust Fund (3% vs. 10%). On the other hand, a few more truckers than last year cite laws about vehicle weight as a concern—14% in 2024 vs. 7% in 2023.

(For more trucking information, find out which 10 companies offer the highest driver salaries.)