2021 Trucking Perspectives

Through its exclusive annual survey of motor carriers and shippers, Inbound Logistics offers a picture of the trucking industry in an economy distorted by supply chain disruptions.

Remember the start of 2021, when we thought COVID-19 vaccines would signal a return to normal in global trade? How wrong we were! The Delta variant has lengthened the pandemic, and a cascading series of supply chain disruptions has kept companies around the world in a continuous state of agitation.

Trucking Perspectives Methodology

We’ve seen production lines shut due to COVID outbreaks, shortages in key commodities, increased demand for many products, tight transportation capacity, soaring freight rates, congestion at ocean ports and rail terminals—the list of obstacles goes on and on.

All those conditions present special challenges to truckers and the shippers they serve. How do you tell your trucker when to arrive for a pickup when your container is sitting on a vessel at sea, waiting for a berth? How do manufacturers and their carriers plan for future transportation needs when manufacturers don’t know when suppliers can ship essential components? How do shippers keep product moving while controlling costs as rates climb?

Each year, Inbound Logistics surveys shippers and motor carriers to find how they’re doing in the current environment, learn what issues are on their mind, and see what they expect for the future. In 2021, the survey gave us a chance to take the trucking market’s pulse in highly unusual times.

As the following report shows, the disruptions of 2021 have altered some priorities for truckers and shippers. For instance, many more truckers than last year say providing capacity is one of the greatest challenges they face today, and many more shippers say that one of their greatest challenges is finding capacity. Also, the proportion of shippers who say they’re having trouble efficiently matching supply with demand has risen.

On the brighter side, more truckers now provide service throughout North America, after a marked pullback from cross-border trade in 2020. And very few truckers are having trouble finding and retaining customers.

Some issues in the trucking market are perennial. For instance, driver-related costs remain a challenge for trucking companies, and shippers continue to value reliability and price above all else in their relationships with motor carriers.

Is the current trucking landscape an aberration or the shape of things to come? In the midst of all the changes, it’s impossible to tell. But here’s how the environment looks right now.

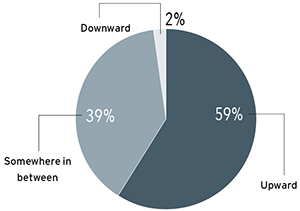

TRUCKERS: As a leading economic indicator, where do you see the economy trending?

Tight truck capacity and high trucking rates indicate there’s a lot of freight moving these days—materials and components to factories, and finished goods to distribution centers, stores, and customers’ homes. All that activity signals a booming economy. And that’s what truckers tell us. In 2020, trucking respondents—busy shipping essential goods during COVID shutdowns—were already feeling optimistic about economic trends. Forty percent said they thought the economy was heading upward, and only 9% predicted a downturn. In 2021, a lot more truckers—59%—say the economy is moving in a positive direction. Thirty-nine percent say the economy stands somewhere in-between up and down, and a mere 2% predict an economic drop.

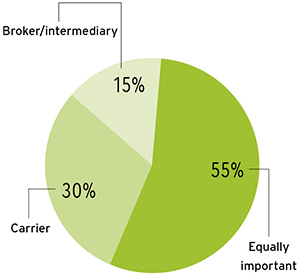

SHIPPERS: Which is more important, your relationship with your carrier or with your broker/intermediary?

Many shippers buy transportation through third-party partners as well as directly through carriers. Among our shipper-respondents, 55% say they place equal value on their relationships with carriers and with brokers or other intermediaries. Thirty percent give top priority to carriers, and 15% say their relationships with intermediaries are more important.

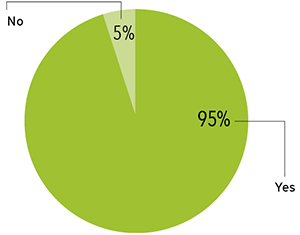

SHIPPERS: Do you buy or participate in the sourcing/purchasing of trucking services?

Ninety-five percent of the shipper-respondents in this year’s survey participate in the sourcing or purchasing of trucking services.

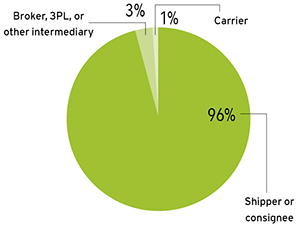

SHIPPERS: What is your role?

Nearly all the shippers who participated in the survey this year, 96%, are shippers or consignees. Another 3% are brokers, 3PLs, or other intermediaries who buy trucking services from carriers on behalf of their clients.

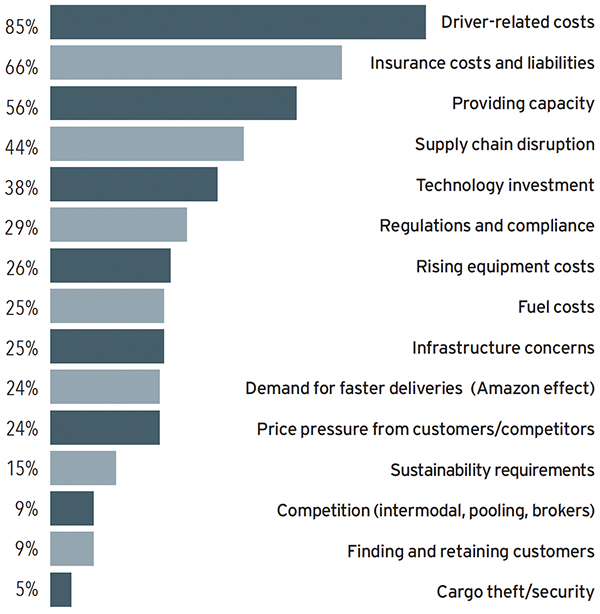

Truckers: What are your greatest challenges?

When it comes to challenges that truckers face, the biggest news concerns a challenge that has mostly vanished over the past year. In 2020, 52% of truckers said they faced challenges finding and retaining customers. This year, that number is a mere 9%. The reason for this change probably lies in another data point. In 2021, 56% of truckers report challenges related to providing capacity, up from 29% in 2020. These days, as companies scramble to meet high customer demand and overcome product shortages to replenish inventories, few motor carriers have trouble finding takers for space on their trucks.

Other challenges that have grown over the past year are supply chain disruption (44% in 2021 vs. 32% in 2020), fuel costs (25% in 2021 vs. 10% in 2020), demand for faster deliveries (24% in 2021 vs. 19% in 2020), and sustainability requirements (15% in 2021 vs. 7% in 2020). At the same time, some concerns have seen a drop. Notably, in 2020, 47% of truckers contended with price pressure from customers and competitors, while in 2021 only 24% grapple with that issue. When capacity is scarce, shippers who urgently need trucks for their loads are less likely to quibble about price.

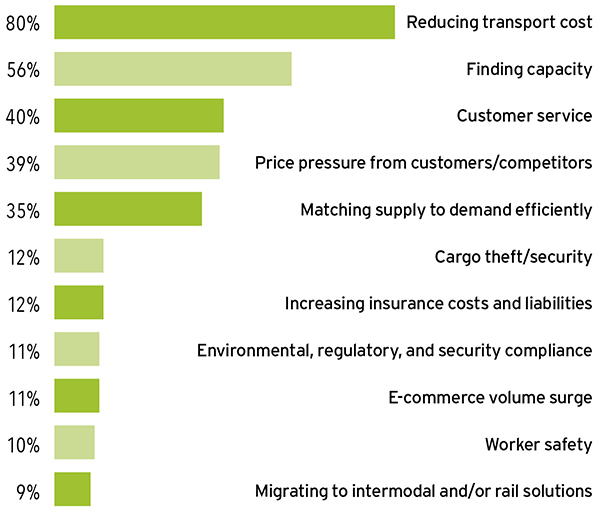

SHIPPERS: What are your greatest challenges?

With freight rates soaring, it’s no wonder 80% of shippers cite the need to reduce transportation costs as one of their greatest challenges. But the really striking response from shippers this year concerns capacity. While 38%—already a significant proportion—cited capacity challenges in 2020, this year 56% of shippers name this issue. That’s exactly the same as the proportion of truckers who say they face obstacles in providing capacity.

Another interesting change from 2020 is the proportion of shippers who say they face challenges efficiently matching supply to demand—35% this year, compared with 28% last year. One thing that hasn’t changed is the small segment of our shipper-respondent pool that faces challenges dealing with a surge in e-commerce volume. The number this year is only 11%, just as it was in 2020. Despite the ever-growing number of purchases made online, it seems that respondents involved in the e-commerce market are handling the volume well.

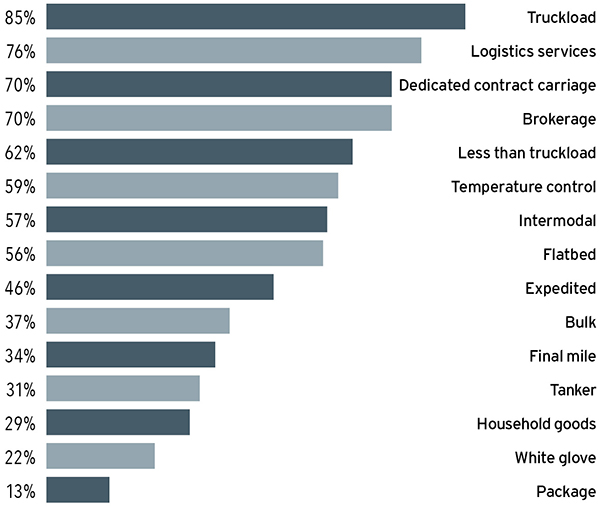

Truckers: What primary types of service do you offer?

If you need to move a full truckload, you won’t have to look far for a transportation partner: 85% of trucking companies in our survey offer that service. (Whether any given company has capacity available to fit your needs these days is a separate question.) A large number of trucking companies can also do more than simply move loads on their own trucks: 76% offer logistics services, and 70% can serve as transportation brokers.

Among the other transportation services that motor carriers offer, the most common are dedicated contract carriage (provided by 70%) and less than truckload (62%). To accommodate the growing demand for direct-to-consumer fulfillment, 34% of respondents offer final-mile delivery, 22% offer white-glove delivery, and 13% offer package service.

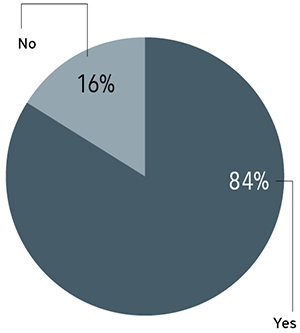

Truckers: Do you have a freight brokerage or logistics services division/subsidiary?

Most of the motor carriers that participated in our survey—84%—offer freight brokerage or logistics services through a division or subsidiary.

Truckers: What industries/commodities do you serve?

A large majority—84%—of our trucker-respondents serve companies in the food and beverage industry, making that the most common customer category. Nearly as many truckers, 80%, handle “freight all kinds,” a term that refers to different categories of product consolidated into a single load. Other commodities or industries that play a big role for our respondents include construction and building materials (72%), automotive (71%), retail and e-commerce (69%), and high-value products (59%). Only 35% of our respondents move freight for government customers. That’s a smaller proportion than in 2020, when 42% of respondents served shippers in the public sector.

Truckers: What is your operating area?

This year, cross-border business seems to have rebounded, now that the economy has recovered from the first shocks of COVID-19. In 2021, 70% of motor carriers in our survey name North America as their operating area, while 30% say they cover just the United States. In 2020, truckers seemed to be pulling back from the cross-border market. Then, just 57% of trucker-respondents said they operate throughout North America, compared with 65% in 2019.

Truckers: Do you provide global services beyond North America?

While cross-border service in North America has contracted and expanded, the proportion of trucking companies that provide service beyond this continent has held steady—68% in 2021, compared with 69% in 2020.

SHIPPERS:What are the most important factors to consider when choosing a motor carrier?

When shippers choose their motor carriers, the top traits they look for are reliability and price. Of the two, shippers value reliability slightly more: 87% of those who participated in this year’s survey name it as one of the most important factors they use to evaluate motor carriers. Eighty percent name price as a top consideration. Number three on the list is customer service, cited by 70% of respondents.

In a year when shippers must work especially hard to find space on trucks for their goods, it makes sense that shippers particularly value carriers that can provide capacity when needed. In 2020, 42% of shippers named capacity as an important factor to consider when choosing a trucker. In 2021, that number rose to 55%.

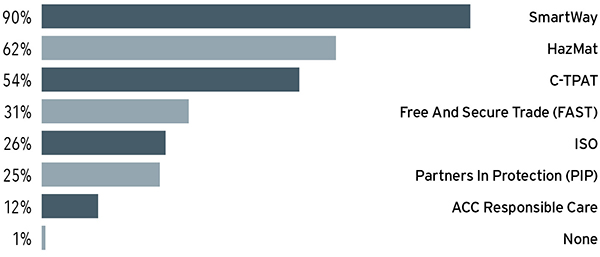

Truckers: What certifications do you hold?

Clearly, trucking companies know what’s good for the environment is good for business. Among respondents to our survey, 90% are certified with the U.S. Environmental Protection Agency’s SmartWay program, through which they share information about their efforts to use less fuel and curb carbon emissions. The second-most common certification, held by 62%, allows truckers to transport hazardous materials. That number has dropped since 2020, when 80% of respondents held hazmat credentials. Another certification that has grown less popular since 2020 is the Customs Trade Partnership Against Terrorism (C-TPAT) program. Last year, 62% of respondents said they participated in C-TPAT, which can make it easier to bring goods through airports and ocean ports and across international borders. This year, the number is 54%. But participation in another border-crossing program, Free And Secure Trade (FAST), has stayed roughly steady, at 31% this year compared with 33% in 2020.

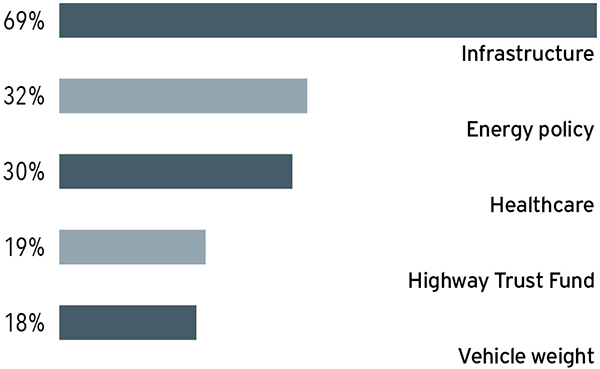

Truckers: What legislative measures have the greatest impact on your business?

As motor carriers completed our 2021 survey, a historic infrastructure bill was making its way through the U.S. Congress. Many respondents will surely be pleased to see a final version of that bill signed into law, as 69% of them point to infrastructure as one of the legislative measures that will have the greatest impact on their business. No other legislative issue draws nearly as much attention. Just 32% of trucker-respondents think that the second-ranking issue on the list, energy policy, will significantly affect their businesses. In 2020, a fair number of truckers—44%—had healthcare policies on their minds. This year, that number dropped to 30%.

Another interesting change concerns vehicle weight. Although it remains the legislative measure least likely to keep truckers awake at night, it seems to have gained a bit more stature. In 2021, 18% of trucking respondents note that as an important legislative issue, compared with just 8% in 2020.

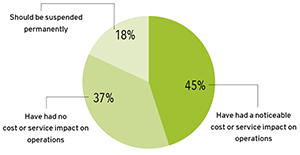

SHIPPERS:How do you feel about Hours-of-Service regulations?

While CSA regulations cause some sort of inconvenience for 36% of shippers, a larger group have issues with federal regulations that limit the number of hours a driver can stay on the road. Forty-five percent of respondents say these Hours-of-Service regulations have made an impact on cost or service in their operations. But only 18% of shippers in the survey say they want to get rid of HOS regulations altogether.

SHIPPERS:Have you experienced a shortage of truck capacity?

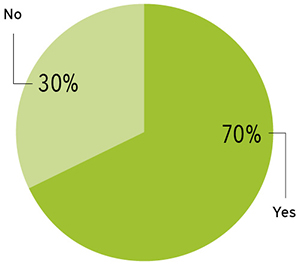

Space on a truck was already hard to find in 2020, when 61% of shipper-respondents told us they had experienced a shortage of truck capacity. This year, with companies struggling to get delayed components into factories and delayed products into the retail pipeline, capacity has become a challenge for even more shippers, 70%. Is it any wonder that so many of them have also seen rate increases?

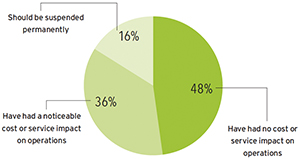

SHIPPERS:How do you feel about CSA regulations?

Just less than half of our shipper-respondents—48%—say that the Federal Motor Carrier Safety Administration’s Compliance, Safety, and Accountability Act (CSA) has not affected the cost of their operations or made an impact on service. The CSA program monitors and evaluates motor carriers for safety performance and intervenes as needed. Another 36% of shippers say that CSA has made a noticeable impact on service or cost. But only 16% of shippers say this program should be suspended permanently.

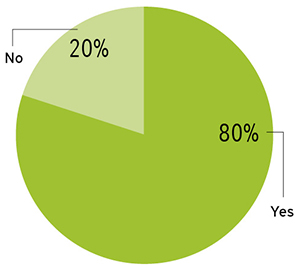

SHIPPERS:Have you experienced rate hikes apart from fuel surcharges?

There’s no doubt about what COVID-19 and its effects on the world economy have done to transportation rates. Among our shipper-respondents, 80% report rate increases apart from any fuel surcharges their carriers may have imposed. This is exactly the same proportion as in 2020.

Trucking Perspectives Methodology

Gathering insights from both shippers and over-the-road carriers, our annual Trucking Perspectives market insight report provides a comparative analysis supported by empirical data and anecdotal observations. Our outreach comprises two parts.

1. More than 200 trucking companies completed a questionnaire that documents their assets, service capabilities, operational scope, and areas of expertise. We also asked carriers to comment on challenges and opportunities in today’s market.

2. We reached out to freight shippers to shed light on industry trends, regulatory challenges, and their partnerships with carriers.